Debt Trap Debbie: Sabotaging Obama on Payday Lending Reform. Suspiciously Timed Contributions from Unsavory Lenders.

High-profile Congresswoman Debbie Wasserman Schultz (D-FL) has come under fire in recent weeks after signing on to co-sponsor legislation (H.R. 4018) that undermines President Obama’s Consumer Financial Protection Bureau (CFPB) as it prepares to announce new rules designed to rein in the worst abuses of predatory payday lenders.

She has long been a recipient of payday lenders largesse. Over the course of her time in Congress, she has taken in more than $68,000 from payday lending industry executives and special interest political action committees.

What is especially troubling though, is that she has twice received thousands of dollars in contributions from Ian MacKechnie Sr. (whose company pleaded guilty on civil racketeering charges in 1998 and who was barred for life from selling auto insurance in Florida) and other executives of Amscot Financial. The most recent contributions came shortly after signing a letter to CFPB director Richard Cordray encouraging his agency to utilize the “Florida model” when considering new rules to rein in payday lenders. The so-called “Florida model” is highly problematic, rife with loopholes, and does little to protect borrowers from predatory lenders.

This was not the first time Wasserman Schultz received thousands of dollars in campaign contributions from the payday lenders just before or soon after taking official action to benefit the industry. In July 2012, she signed on to a different letter to Cordray advocating the Florida model. And just a few months later, Ian MacKechnie and Amscot executives donated $2500 to her political coffers.

Wasserman Schultz Is Co-Sponsoring Legislation That Undermines President Obama’s CFPB As It Works to Rein in Predatory Payday Lenders

Debbie Wasserman Schultz Is Co-Sponsoring Legislation “That Would Gut the CFPB’s Forthcoming Payday Loan Regulations” and She’s “Attempting to Gin up Support for the Legislation on Capitol Hill.”

“Wasserman Schultz is co-sponsoring a new bill that would gut the CFPB’s forthcoming payday loan regulations. She’s also attempting to gin up Democratic support for the legislation on Capitol Hill, according to a memo obtained by The Huffington Post.” [Huffington Post: “DNC Chair Joins GOP Attack On Elizabeth Warren’s Agency,” 3/1/16]

The Legislation Co-Sponsored by Wasserman Schultz “Would Delay the CFPB’s Rules by Two Years, and Nullify Its Rules in Any State With a Payday Lending Law Like the One Adopted in Florida.”

“The misleadingly titled Consumer Protection and Choice Act would delay the CFPB’s payday lending rules by two years, and nullify its rules in any state with a payday lending law like the one adopted in Florida. The memo being passed around by Wasserman Schultz staffers describes the Florida state law as a “model” for consumer laws on payday loans, and says the CFPB should “adjust their payday lending rules to take into account actions Florida has already taken.” [Huffington Post: “DNC Chair Joins GOP Attack On Elizabeth Warren’s Agency,” 3/1/16]

The “Florida Model” Is a Payday Lender’s Dream: Riddled with Loopholes and Massive Interest Rates. Average Borrower Takes Out 9 Loans.

Payday Lenders in Florida Claimed They Were Credit Service Organizations Not Subject to Florida’s Payday Lending Law.

“Last year, the state Office of Financial Regulation began looking into the practices of EZMoney and Cash America, two Texas-based chains that claim to be “credit-service organizations” not subject to Florida’s payday-loan law. “We’re in the early, fact-finding stages with both of them,” said Ramsden, the agency administrator. “We are aware they’re citing Florida’s credit-service organization law, which was intended to help consumer-credit agencies. In this situation, however, we have payday lenders using it to broker payday loans.” [Sun Sentinel, “Some Payday Lenders Are Flouting Florida’s Reform Law”4/15/2007]

Payday Lenders Claim They Aren’t Subject to Florida’s Payday Lending Law Because They Don’t Receive a Post-dated Check but Rather a Promissory Note That Allows Them to Automatically Withdraw Funds from the Customer’s Bank Account.

“Here’s their argument: The state’s payday law pertains only to lenders that require customers to give them a postdated check written for the amount owed. When the loan comes due, the lender simply cashes the check. But Cash America and EZMoney require no such check — only a promissory note that authorizes the lender to automatically withdraw the money from the customer’s bank account.” [Sun Sentinel, “Some Payday Lenders Are Flouting Florida’s Reform Law”4/15/2007]

Payday Loans In Florida Have an Average APR of 304%, And A Typical Florida Payday Loan Customer Takes Out Nine Payday Loans A Year.

“Data compiled by the nonpartisan Pew Charitable Trusts is similarly dismal. A typical Florida payday loan customer ends up taking out nine payday loans a year and is stuck in debt for nearly half of that year, according to Pew. The average interest rate on Florida’s payday loans is 304 percent — only slightly better than the 390 percent annual average. Critically, the average payday loan amount of $389 is equal to 35 percent of average paychecks in the state — in line with national figures.” [Huffington Post: “DNC Chair Joins GOP Attack On Elizabeth Warren’s Agency”, 3/1/2016]

Check Into Cash Advertises a Payday Loan with an APR of 391.07% In Florida. [Check Into Cash Website, Access 3/8/2016]

Amscot Financial Advertises Payday Loan Rates as High as 312.86%. [Amscot Financial Website, Accessed 3/8/2016]

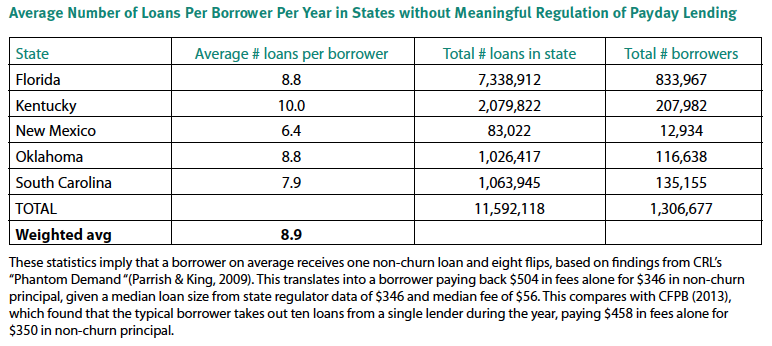

In Florida, There Are Frequent Rollovers With the Average Borrower Taking Out 8.8 Loans Per Year and Almost a Third of Borrowers Taking Out 12 or More Per Year

[Center For Responsible Lending, “Payday Lending Abuses and Predatory Practices” 09/2013]

32.7% of Florida Payday Loan Customers Took Out 12 Loans or More Per Year. [Veritec Solutions Report for The Florida Office of Financial Regulation, May 2012]

Wasserman Schultz Has Taken Official Action to Benefit Payday Lenders Just Before or Soon After Receiving Thousands of Dollars From the Industry

Debbie Wasserman Shultz Has Taken Over $68,000 From Payday Lenders

- Has Taken $5,100 From Payday Lenders in the 2016 Cycle. [FEC Filing, 7/15/2015]

- Took $5,000 From Payday Lenders in 2014 Cycle. [Center for Responsive Politics, 2014]

- Took $12,500 From Payday Lenders in 2012 Cycle. [Center for Responsive Politics, 2012]

- Took $28,000 From Payday Lenders in 2010 Cycle. [Center for Responsive Politics, 2010]

- Took $10,000 From Payday Lenders in 2008 Cycle. [Center for Responsive Politics, 2008]

- Took $7500 From Payday Lenders in 2006 Cycle. [Center for Responsive Politics, 2006]

April 28, 2015: Wasserman Shultz Signed a Letter to CFPB Director Richard Cordray Urging Him to Use the ‘Florida Model’ of Regulation for Payday Loans Rather Than New Rules That Would Purportedly Do an “Immeasurable Disservice” to Consumers by “Eliminating” Payday Loans Used “To Make Ends Meet”

[Letter To CFPB Director Richard Cordray From Wasserman Schultz and Others, 4/28/2015]

Weeks Later She Was Rewarded With Over $5,000 in Campaign Contributions From Executives, Including Ian MacKechnie, of Amscot Financial, a Florida Payday Lending Company

- Ian MacKechnie Sr. (Amscot Financial) | 6/29/2015 | $1,250

- Jean MacKechnie (Amscot Financial) | 6/29/2015 | $1,250

- Ian MacKechnie Jr. (Amscot Financial) | 6/27/2015 | $1,350

- Fraser MacKechnie (Amscot Financial) | 6/27/2015 | $1,250

A Few Months Later, She Endorsed Legislation Based on the “Florida Model” That Would Delay the CFPB Payday Lending Rule by Years

December 2015: Wasserman Shultz Co-Sponsored HR 4018, The Consumer Protection and Choice Act. [Congress.gov; HR. 4018]

- Consumer Groups and Community Organizations Opposed HR 4018 Saying It Would Delay The CFPB’s Rulemaking On Payday Loans by Two Years or More and Was an “Industry-Backed Proposal Based On Florida Law.” “The undersigned civil rights, consumer, labor, faith, veterans, seniors, and community organizations, strongly urge you to oppose H.R. 4018, the “Consumer Protection and Choice Act.” This harmful bill would limit the Consumer Financial Protection Bureau’s (CFPB) ability to protect all consumers against high-cost payday, car title, and installment loans. In addition to delaying the Bureau’s rule-making for two years or longer, H.R. 4018 would allow the payday industry to avoid federal regulation altogether by pushing an industry-backed proposal based on a Florida law1 that has proven ineffective at stopping the payday loan debt trap.” [Center For Responsible Lending, Letter To Congress From Consumer Groups, 12/15/15]

Not the First Time: In July 2012 Wasserman Schultz Signed a Letter to Cordray Telling Him to Pattern Payday Regulations After Florida

July 2012: Wasserman Shultz Signed a Letter to Cordray Asking Him to Use the Florida Model of Payday Loan Regulation

[Letter to CFPB Director Richard Cordray From Wasserman Schultz and Others Obtained by FOIA Request, 7/19/2012]

Just A Few Months Later She Received $2500 From Amscot Financial Executives, Including Ian MacKechnie

- Ian MacKechnie (Amscot Financial) | 11/2/2012 | $1,500

- Fraser MacKechnie (Amscot Financial) | 11/2/2012 | $1,000

Wasserman Schultz’s Payday Benefactors, Florida’s MacKechnie Family, Once Saw Their Company Plead Guilty to Civil Racketeering Charges

Amscot Financial, the MacKechnie Family’s Company, Was Charged with Racketeering and MacKechnie Sr. Was Banned from Selling Auto Insurance for Life in Florida as Part of the Settlement

- 1998: Then-Insurance Commissioner Bill Nelson conducted an undercover sting against MacKechnie Sr.’s insurance company, which led to racketeering charges and a lifetime ban on him selling auto insurance in Florida. Then-Florida Insurance Commissioner Bill Nelson’s “accusation that Amscot tried to trick him and other customers into buying unwanted add-ons for their auto insurance, such as towing services…forced Amscot founder Ian MacKechnie to sell his company’s insurance operations, while his company pleaded guilty to racketeering charges. The uproar indelibly sullied the Amscot name. Or did it? The Amscot name is now emblazoned on a West Shore office building off I-275 in Tampa, and its owner, MacKechnie, presides over one of the fastest-growing financial companies in the Tampa Bay area. Amscot has grown to 46 neighborhood outlets, with leases to open in 24 more locations, including its first in Orlando. MacKechnie says he doesn’t care that his tiff with state insurance regulators led to a lifetime ban on selling auto insurance in Florida. The rest of his bay area financial empire – cashing checks, offering payday loans with high interest rates and other services geared to high-risk customers – has more than compensated. This year, MacKechnie said, he expects Amscot to cash about $600-million worth of checks, provide $160-million worth of payday advances, sell $500-million worth of money orders and provide $100-million worth of advance checks for income tax refunds.” [St. Petersburg Times, 8/10/03]

- Florida Department of Insurance investigated Amscot for systematically ‘sliding’ add-ons such as towing charges and legal services into auto policies, which led to Amscot pleading guilty to civil charges of racketeering in return for criminal charges being dropped against MacKechnie Sr. “By 1986, the Florida Department of Insurance started investigating complaints that Amscot was systematically ‘sliding’ add-ons such as towing charges and legal services into auto policies, ballooning the cost by an average of $100 a year. The insurance commissioner said that when he went undercover at an Amscot location he asked for the minimum policy required under Florida law but an agent sold him a policy that included a towing and car-rental add-on. In August 1998, Amscot pleaded guilty to civil charges of racketeering for duping auto insurance customers and agreed to exit the insurance business. In return, state prosecutors agreed not to pursue criminal charges against MacKechnie.” [St. Petersburg Times, 8/10/03]

MacKechnie and His Son Claimed Triple Digit APR’s Were Reasonable…

- MacKechnie Sr. defended 300% APR’s “as reasonable” and claimed “he sympathizes with his hard-luck customers.” “Not that he has left controversy behind him since settling with state regulators. Financial lending to the poor remains a sensitive, high-risk and sharply criticized industry, particularly payday advance loans. The short-term loans, which are essentially advances on a worker’s salary, carry annual percentage rates of up to 300 percent. MacKechnie defends the short-term interest charges as reasonable. A $50 fee for a $500 loan is cheaper, for instance, than paying a late fee for missing a monthly rent payment, he said. Sometimes, he says, all people need is a little help to get back on their feet before they ‘graduate’ from using a service like Amscot. MacKechnie says he sympathizes with his hard-luck customers.” [St. Petersburg Times, 8/10/03]

- Center for Responsible Lending Reported MacKechnie’s Payday Lending Business Charged APR of 286%, Which His Son Defended. “Consumer groups like the Center for Responsible Lending criticize the cash-advance loans offered by Amscot and other chains, noting their $11 fee on a $100 loan for 30 days is equal to an annual interest rate of 286 percent. They recommend borrowers use credit cards instead. However, MacKechnie countered that many cash-strapped consumers lack credit cards and have no way of meeting financial emergencies.” [News-Journal, 10/26/07]

Yet MacKechnie Claims Amscot Financial Has Never Taken Advantage of a Customer… Ever

- MacKechnie Sr.: “We have never taken advantage of a customer and never will.” “‘There is a demand and need for these services. We have never taken advantage of a consumer and never will,’ CEO MacKechnie said.” [St. Petersburg Times, 7/4/09]

MacKechnie Sr. Called Critics of Payday Lending “Elitist”

- MacKechnie Sr. claimed it was “elitist” to criticize payday lenders. “City officials on Wednesday called off a controversial deal that allowed Amscot Financial to accept its utility payments, just days before the City Council was expected to publicly denounce the company’s check cashing and payday advance services. At least six of the city’s eight council members had expressed reservations about Amscot’s business dealings and its service fees. Payday loans, which are essentially advances on a worker’s salary, can carry annual percentage rates of about 300 percent. ‘A city ought to be doing everything we can to bring people into the financial mainstream and this kind of very high interest lending is the opposite of that,’ said Council member Karl Nurse. ‘It’s like quicksand.’…Founder Ian MacKechnie said the criticism of Amscot and its clients is insulting. ‘I see it as elitist,’ he said earlier this week. ‘They are talking down to people who they don’t know. We think what’s most important is that people have choices.’” [St. Petersburg Times, 12/12/08]

And His Son Opposed Federal Oversight of Payday Lending Industry

- MacKechnie Jr. opposed federal regulation of payday lenders: “We’re not Wall Street.” “Nearly a decade after a major regulatory overhaul in Florida, payday lenders appear as common on Central Florida street corners as McDonald’s. The industry contends it’s now so tightly regulated here that it hands out small loans with triple-digit annual percentage rates as harmlessly as the fast-food joint sells burgers and fries. Florida’s protections for consumers are stricter than many states but not as stringent as others that ban payday loans outright or cap APR’s at 38 percent or below. In Florida, the APR on a $500 loan, the maximum, is about 266 percent. And the Internet remains a harbor for payday lenders who prey on consumers with the most abusive tactics. This national patchwork has Congress trying to sweep the industry into its Wall Street reform package, and the issue is expected to come up for debate this week as members of the House and Senate meet to work out their differences on the legislation. That hasn’t gone unnoticed by the industry, which has fiercely lobbied to be excluded from the reform package. ‘We’re not Wall Street,’ said Ian A. MacKechnie, Amscot Corp. executive vice president and son of the company’s founder by the same name. ‘We didn’t cause the financial crisis. We’re part of Main Street.’ Tampa-based Amscot is one of the companies that has flourished in Florida since payday lending laws were overhauled in 2001, largely the result of a series of industry critical editorials in the Sentinel. It has 174 stores in 15 counties. At the beginning of 2004 there were no Amscot stores in Central Florida; today there are 70 with 32 in Orange County alone.” [Orlando Sentinel, 6/21/10]

MacKechnie Sr. Has Made Serious Money from the Payday Industry – Has Been Ranked One of the Richest Men in Scotland for Years

- 2004: MacKechnie was ranked among the top 50 richest in Scotland, worth $87 million. [Glasgow Evening News, 4/17/04]

- 2005: MacKechnie was ranked among the top 50 richest in Scotland, worth $136 million. [London Sunday Times, 4/3/05]

- 2006: MacKechnie was ranked among the top 50 richest in Scotland, worth $120 million. [London Sunday Times, 4/23/06]

- 2007: MacKechnie was ranked among the top 50 richest in Scotland, worth $138 million. [London Sunday Times, 4/29/07]

- 2008: MacKechnie was ranked among the top 50 richest in Scotland, worth $149 million. [London Sunday Times, 4/27/08]

- 2009: MacKechnie was ranked among the top 50 richest in Scotland, worth $141 million. [London Sunday Times, 4/26/09]

- 2012: MacKechnie and family was worth $237 million. [The Scotsman, 8/15/12]