Money Talks: Meet the Payday Industry Cronies Testifying at Today’s Sham Congressional Hearing

On February 11, the Financial Institutions and Consumer Credit Subcommittee of the House Financial Services Committee will hold a hearing entitled “Short-term, Small Dollar Lending: the CFPB’s Assault on Access to Credit and Trampling of State and Tribal Sovereignty.”

If you could not tell from the title alone, the hearing is not meant shed any light on the debt trap many borrowers find themselves in after taking out payday and other short-term, high-interest loans. Instead, the payday lending industry’s allies in Congress are holding this sham of a hearing to attack the Consumer Financial Protection Bureau (CFPB) as it prepares new rules to rein in the worst of these predatory lenders.

Like the Members of Congress organizing the hearing, those being called to testify are allies of the payday lending industry. They include:

Greg Zoeller: Indiana’s Attorney General Has Raked in $23,000 in Campaign Cash from Payday Lenders Since 2010, Including a $1000 Contribution to His Nascent House Campaign Less Than 3 Months Ago

Ace Cash Express Is One of Six PACs to Have Given to Zoeller’s Congressional Campaign Thus Far

Ace Cash Express, Inc. PAC | 11/24/15 | $1,000.00

[Center for Responsive Politics]

From 2010-2014, Zoeller Raked in $22,000 in Contributions from Payday Lenders

Advance America | 10/15/14 | $1,000.00

Advance America | 11/05/13 | $1,000.00

Cash America | 07/23/13 | $2,000.00

Cash America | 11/01/12 | $1,000.00

Advance America | 07/09/12 | $1,000.00

Check Into Cash of Indiana, LLC | 07/09/12 | $2,000.00

Cash America International, Inc. | 07/03/12 | $2,000.00

TC Loan Service, LLC | 07/03/12 | $2,000.00

Check Into Cash of Indiana, LLC | 12/14/11 | $1,000.00

ACE Cash Express, Inc. PAC | 06/28/11 | $1,000.00

Advance America | 06/28/11 | $1,000.00

Check Into Cash of Indiana, LLC | 06/28/11 | $1,000.00

Axcess Financial, Inc. | 10/06/10 | $1,000.00

Cash America International, Inc. | 10/06/10 | $2,500.00

DMA Financial Corp. | 10/06/10 | $1,500.00

TC Loan Service, LLC | 10/06/10 | $1,000.00

[Indiana Campaign Finance Disclosures]

Thomas Miller: Scholar at Mercatus Center, a George Mason University Think Tank Founded and Funded by the Koch Brothers

Thomas W. Miller Is a Visiting Scholar with The Mercatus Center at George Mason University.

“Thomas W. Miller, Jr., is a visiting scholar with the Mercatus Center at George Mason University, whose research project focuses on foreclosures for the Project for the Study of American Capitalism and a project on small dollar loans for the Financial Markets Working Group. Dr. Miller is a Professor of Finance and the inaugural holder of the Jack R. Lee Chair in Financial Institutions and Consumer Finance at Mississippi State University, and co-author of “Fundamentals of Investments: Valuation and Management” and “Derivatives: Valuation and Risk Management.” He has held positions at Saint Louis University, Washington University in St. Louis, the University of Missouri, and has taught in Italy and France.” [Thomas Miller Bio, Mercatus.org]

The Koch Brothers Founded the Mercatus Center at George Mason University and Have Donated More Than $30 Million to George Mason “Most of Which Has Gone to the Mercatus Center.

“In the mid-eighties, the Kochs provided millions of dollars to George Mason University, in Arlington, Virginia, to set up another think tank. Now known as the Mercatus Center, it promotes itself as “the world’s premier university source for market-oriented ideas—bridging the gap between academic ideas and real-world problems.” Financial records show that the Koch family foundations have contributed more than thirty million dollars to George Mason, much of which has gone to the Mercatus Center, a nonprofit organization. “It’s ground zero for deregulation policy in Washington,” Rob Stein, the Democratic strategist, said. It is an unusual arrangement. “George Mason is a public university, and receives public funds,” Stein noted. “Virginia is hosting an institution that the Kochs practically control.” [New Yorker, 8/30/10]

The Founder of the Mercatus Center Heads Koch Industries Lobbying Operation, Is President of the Charles G. Koch Charitable Foundation, and Director and Co-Founder with David Koch of Americans for Prosperity.

“The founder of the Mercatus Center is Richard Fink, formerly an economist. Fink heads Koch Industries’ lobbying operation in Washington. In addition, he is the president of the Charles G. Koch Charitable Foundation, the president of the Claude R. Lambe Charitable Foundation, a director of the Fred C. and Mary R. Koch Foundation, and a director and co-founder, with David Koch, of the Americans for Prosperity Foundation.” [New Yorker, 8/30/10]

Kelvin Simmons: Once Expressed Concern About the Exorbitant Fees Charged by Short-term Loans, Check Cashing, and Title Loan Businesses, but Is Currently a Payday Lending Lobbyist in Missouri Attempting to Stop Regulation of the Industry

As a Councilman in Kansas City, Kelvin Simmons Supported Zoning Changes That Would’ve Restricted Where Short-term Loan Businesses Could Be Located and “said He… Was Concerned About the Exorbitant Fees That the Businesses Charged.”

In January of 2000, Kelvin Simmons “testified in support” of an ordinance that would have restricted check-cashing and short-term loan shops, “to areas zoned specifically for regional commercial use” and “would prevent them from locating adjacent to or across from residential areas.” At the time, Kelvin Simmons said, “‘We have enough of these businesses already.’” [The Kansas City Star, 01/13/2000]

At the time, Kelvin Simmons also said, “‘I am not opposed to the industry and the services they provide as long as people know what the service is.’” Simmons added, “‘But I am opposed to their proliferation in neighborhoods.’” [The Kansas City Star, 01/23/2000]

In March of 2000, Kelvin Simmons, “said he… was concerned about the exorbitant fees that the businesses charged but acknowledged that only the state – not the city – had the power to regulate their fees.” [The Kansas City Star, 03/30/2000]

In May of 2000, while serving on the Kansas City Council, Kelvin Simmons voted for the final version of the bill that required “anyone who wants to open a check-cashing or title-loan business… to demonstrate to the city that it would have no negative effect on properties within 500 feet.” [Kansas City Council Minutes, 05/04/00 and The Kansas City Star, 05/04/2000]

Simmons Was Hired as a Lobbyist by a Payday Lender Group and Just a Few Weeks Later Worked to Target African American Clergy and Community Leaders to Oppose Regulation

“In February 2012, the Rev. Starsky Wilson of St. Louis sat down at a table in the Four Seasons Hotel. The floor-to-ceiling windows revealed vistas of the city’s skyline. Lined up in front of him were two lobbyists and an executive, he remembers. The meeting was part of an extraordinary counteroffensive by payday and other high-cost lenders against a ballot initiative to cap what such lenders can charge in interest and fees. Outspending their opponents – faith, labor and community groups – by almost nine to one, the industry had launched a multipronged effort, one that offers a rare view into the lenders’ try-anything tactics to stay in business. The lenders had targeted a community that was both important to their profits and crucial to the petition drive: African-Americans. Wilson, like the majority of his flock, is black. So were the two lobbyists. Kelvin Simmons had just a few weeks before been in charge of the state budget and was a veteran of Missouri politics. His new employer was the international law firm SNR Denton now called Dentons, and he was working on behalf of Stand Up Missouri, a group representing installment lenders. Next to Simmons was Rodney Boyd, also African-American and for the previous decade the chief lobbyist for the city of St. Louis. He, too, worked for SNR Denton.” [St. Louis Post Dispatch, 08/05/2013]

- More Than a Dozen African-American Clergy in Missouri Met with The Lobbyists. “The lobbyists and Tom Hudgins, a white executive with an installment lender, urged Wilson to rethink his commitment to the rate-cap ballot initiative. Wilson was not swayed, but he was only one target among many. At the Four Seasons, Wilson says, he bumped into two other leaders of community organizations who had been summoned to hear Stand Up Missouri’s message. He said he also knew of more than a dozen African-American clergy who met with the lobbyists. Their message, that installment loans were a vital credit resource for middle-class African-Americans, was convincing for some. As a result, Wilson found himself mounting a counter-lobbying effort. A spokesperson for Simmons and Boyd’s firm declined to comment.” [St. Louis Post Dispatch, 08/05/2013]

Simmons Is Still an Active Lobbyist for Payday Lending Group Stand up Missouri in Missouri

Stand Up Missouri

P.O. Box 63

Jefferson City, MO 65102

325-650-9756

A

2/24/2012

[Kelvin Simmons Missouri Lobbying Records]

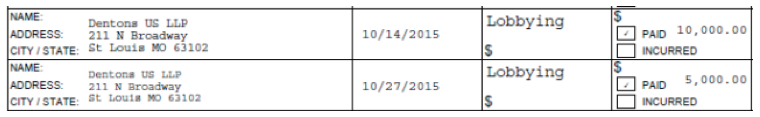

Stand up Missouri Paid Simmons Lobbying Firm Dentons US LLP $15,000 As Recently as October

[Missouri Campaign Finance Records, Stand Up Missouri, 01/15/16]

Dennis Shaul: Head of Payday Industry’s Special Interest Trade Group That Spends Millions of Dollars Lobbying Congress to Benefit Predatory Lenders

Dennis Shaul Is the CEO of Community Financial Services Association of America (CFSA)

Dennis Shaul Is The CEO of Community Financial Services Association of America. “Dennis Shaul is the chief executive officer for the Community Financial Services Association of America (CFSA). Established in 1999, CFSA is the national organization for small dollar, short-term lending, representing the majority of nonbank storefront lenders across the United States.” [Dennis Shaul Bio, American Banker]

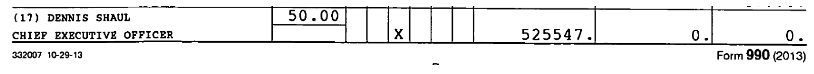

CFSA Paid Dennis Shaul Over Half a Million Dollars in 2013

[CFSA 2013 IRS Form 990]

CFSA Is the Payday Lending Industries Well-Funded Trade Association

“The Community Financial Services Association of America (CFSA) is the national organization dedicated to advancing financial empowerment for consumers through small dollar, short-term loans. Now in its 14th year, CFSA was established to promote laws and regulations that protect consumers, while preserving their access to credit options, and to support and encourage responsible payday advance industry practices.” [cfsaa.com]

2012: CFSA Received $6,960,431 In Funding. [2012 IRS Form 990]

2011: CFSA Received $6,636,637 In Funding. [2011 IRS Form 990]

2010: CFSA Received $6,464,712 In Funding. [2010 IRS Form 990]

CFSA Spends Millions of Dollars Lobbying Congress for Less Regulation of Payday Loans

2014: CFSA Spent $577,000 On Federal Lobbying. [Center for Responsive Politics]

2013: CFSA Spent $973,101 On Federal Lobbying. [Center for Responsive Politics]

2012: CFSA Spent $2,545,652 On Federal Lobbying. [Center for Responsive Politics]

2011: CFSA Spent $2,275,000 On Federal Lobbying. [Center for Responsive Politics]

2010: CFSA Spent $2,437,500 On Federal Lobbying. [Center for Responsive Politics]

2009: CFSA Spent $2,560,000 On Federal Lobbying. [Center for Responsive Politics]

Sherry Treppa: Chairperson of Tribe That Has Payday Lending Operations, but Investigative Report Found That Tribal Members Get Few Jobs and Little Financial Benefit from the Business

Sherry Treppa Is the Chairperson of the Habematolel Pomo of Upper Lake

Sherry Treppa Is the Chairperson for The Habematolel Pomo of Upper Lake, A Federally Recognized Indian Nation. “Sherry Treppa is Chairperson for the Habematolel Pomo of Upper Lake, a federally recognized Indian Nation located in Upper Lake, California. Treppa was elected to the Tribe’s seven-member Executive Council as Vice Chairperson in 2004. She was re-elected in 2006, and served as Vice Chairperson until 2008, when she was then elected to her current position. As Chairperson, Treppa is tasked with leading the efforts towards preserving the tribe’s Pomo culture and inalienable right to sovereignty, while continually striving for economic self-reliance, through e-commerce, gaming and other economic opportunities unique to tribal lands. [Sherry Treppa Bio, Upperlakepomo.com]

The Tribal Council of Habematolel Pomo Has Payday Lending Enterprises, but an Investigative Report Found Little of the Money Generated Goes to Benefit Tribal Members…

The Tribal Council of Habematolel Pomo of Upper Lake Has Payday Lending Operations “But Little of the Revenue That Flows Through These Tribal Businesses Ends Up in The Rancheria or Benefiting Tribal Members.” “And it’s no coincidence that the same structure also houses the office of the tribal council of the Habematolel Pomo of Upper Lake. The Native American tribe’s lending enterprises have names like Silver Cloud Financial and Mountain Summit Financial, reflecting the Native American heritage of the rancheria, as these settlements are called. The U.S. government established them for landless Indians in California in the early 20th century, but unlike reservations, a single rancheria can include members of multiple tribes. Tribal sovereignty allows the rancherias’ businesses to claim immunity from state usury laws, making them convenient shelters for lenders who want to evade regulators. Yet little of the revenue that flows through these tribal businesses ends up in the rancheria or benefiting tribal members, as attested by the cluster of rundown houses nearby, where some members of the tribe live. They don’t look like villainous tycoons preying on low-income Americans. They look more like those cash-strapped loan customers themselves.” [Aljazeera America, “Payday Nation”, 2014]

Treppa Claimed That Payday Lending Operations Fund the Tribe’s Youth, Infrastructure and Cultural Programs “But Rancheria Members Such as Vanessa Niko Said They Don’t See These Benefits On the Rancheria Itself, Perhaps Because None of the Tribal Council Members Lives There.” “The Habematolel Pomo know this. Most of the rancherias’ land is already occupied by the wigwam-shaped Running Creek casino, which opened in 2012. But Running Creek, with its 349 slot machines, six gaming tables and two restaurants, has failed to live up to its promise. The revenues, wrote Sherry Treppa, the head of the tribal council, “have been below expectations.” The casino cost the Habematolel Pomo $30 million to build. The revenue generated from the payday lending businesses, Treppa said, funds the tribe’s youth, infrastructure and cultural programs. Some of it is also used to pay for the schooling of tribal children. But rancheria members such as Vanessa Niko said they don’t see these benefits on the rancheria itself, perhaps because none of the tribal council members live there. And Niko doesn’t see any new employment opportunities opening up for herself or her five children. “They don’t have jobs for us unless you’re on the council,” she said. Treppa declined all calls for comment after sending a list of talking points by email.” [Aljazeera America, “Payday Nation”, 2014]

…And Tribe Members Interviewed in 2014 Said None of Them Had Any Jobs Related to Payday Lending

“Habematolel Pomo Members Interviewed On a Recent Visit Said None of Them Had Any Jobs Related to Payday Lending.” “The payday lending enterprises are not operated out of the settlement, and Habematolel Pomo members interviewed on a recent visit said none of them had any jobs related to payday lending. In fact, there are few jobs of any kind here. William Snow, 51, left the settlement straight out of high school. “There’s nothing for young folks to do around here,” he said.” [Aljazeera America, “Payday Nation”, 2014]

Other Tribes Like the Habematolel Pomo Also “Appear Online as The Owners of Payday Lending Enterprises…But The Call Centers and Other Operations Are Elsewhere” And Tribes Get as Little as 1% Of The Revenue. “Like the Habematolel Pomo, these tribes appear online as the owners of payday lending enterprises. But the call centers and other operations are elsewhere, and the tribes themselves get as little as 1 percent of the revenue. The entire online payday lending industry brought in nearly $4.3 billion in revenue in 2012.” [Aljazeera America, “Payday Nation”, 2014]

Payday Lenders Use Tribes as “convenient Shelters for Lenders Who Want to Evade Regulations”

“Tribal Sovereignty Allows the Rancherias’ Business to Claim Immunity from State Usury Laws, Making Them Convenient Shelters for Lenders Who Want to Evade Regulators.” “Tribal sovereignty allows the rancherias’ businesses to claim immunity from state usury laws, making them convenient shelters for lenders who want to evade regulators.” [Aljazeera America, “Payday Nation”, 2014]