Campaign Targeting Mnuchin’s Foreclosure Record Expands to Arizona and Nevada Mailboxes

Mailer Targeting Communities Hit Hardest During Foreclosure Crisis Reveals Extent of Damage Caused by Mnuchin’s Bank in AZ and NV

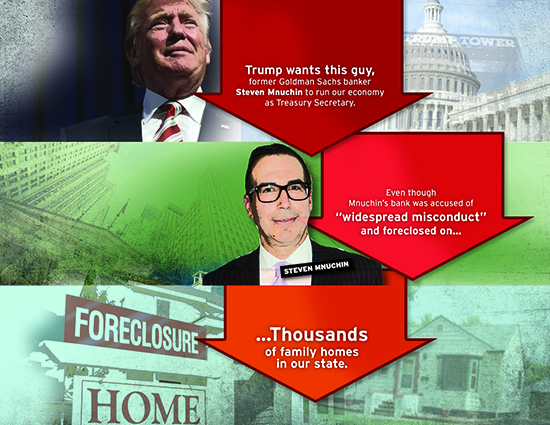

WASHINGTON, D.C. – Today, Allied Progress expanded its effort to connect with working families in Nevada and Arizona who were victims of the unethical foreclosure practices of a scandal-plagued bank run for years by Trump Treasury Secretary nominee Steven Mnuchin. The effort includes a mailing (view the mailings in high-resolution here) to communities hit hardest during the foreclosure crisis and details the extent of damage caused by Mnuchin’s bank in Arizona and Nevada.

As the mailing reveals for the first time, over the past eight years OneWest, the bank Mnuchin ran, foreclosed on 3,826 Arizona and 3,686 Nevada family homes. These previously unreleased figures were compiled by California Reinvestment Coalition using foreclosure data from PropertyRadar.

Over the same time, the bank was accused of “widespread misconduct” and according to an analysis by Bloomberg News, Mnuchin personally made an estimated $380 million from OneWest.

Residents living in Arizona and Nevada zip codes hit hardest by the foreclosure crisis will receive the mailing. It encourages recipients to contact Senators Jeff Flake (R-AZ) or Dean Heller (R-NV) and ask that they reject Mnuchin’s nomination. The expanded effort is part of Trump Transparency Project, an Allied Progress initiative to hold the incoming administration accountable on economic appointments and policies that betray America’s middle class. The project recently aired television ads in Arizona and Nevada targeting Flake and Heller, and co-sponsored an ad in Arizona, Nevada, Iowa, and Washington, D.C. featuring one of the victims of Mnuchin’s bank.

[View Both High-Resolution Mailers Here]

As the mailer notes, rather than standing up to Mnuchin for his record of profiting from the foreclosure crisis, Senators Flake and Heller have held closed door meetings with and praised Mnuchin.

“Arizona and Nevada were hit particularly hard by the foreclosure crisis that Steven Mnuchin and his Wall Street buddies helped to create — and profited from. Instead of standing up to Mnuchin who victimized thousands of their constituents, Senators Flake and Heller are coddling him,” said Allied Progress Executive Director Karl Frisch. He continued, “Residents of Arizona and Nevada need to know that President-elect Trump isn’t on their side, and neither are their senators. It’s past time to stand up to the Goldman Sachs crowd that profited on the backs of hard-working Americans.”

Steven Mnuchin is a longtime Wall Street insider, formerly a second-generation executive at Goldman Sachs. At the height of the Great Recession, Mnuchin purchased IndyMac, later renamed OneWest Bank. Under his leadership OneWest foreclosed on tens of thousands of homeowners, including in Arizona and Nevada, with the federal government absorbing the losses while the bank made billions in profits for Mnuchin and his colleagues.

The foreclosure practices of Mnuchin’s bank were disputed and came under intense fire, with one judge finding that OneWest committed “harsh, repugnant, shocking and repulsive” acts, characterizing the bank’s conduct as “inequitable, unconscionable, vexatious and opprobrious.” In another case, OneWest attempted to foreclose on a 90-year-old woman over a payment that was short by 27 cents.

# # #

Allied Progress is a nationwide, progressive advocacy organization that uses hard-hitting research and creative campaigns to hold Wall Street and powerful special interests accountable. Since launching in 2015, the organization has led high-profile campaigns on several issues including reforming the payday lending industry and exposing the those working to cripple the Consumer Financial Protection Bureau (CFPB).

To speak with Allied Progress about this release, please contact Mike Czin, 202-286-7654.