100’s of Organizations Join Efforts to Raise Awareness and Collect Public Comments on CFPB Rule to Rein In Predatory Payday Lending

StopPaydayPredators.org Offers Consumers Forum to Submit Comments to Consumer Financial Protection Bureau and Demand Strongest Possible Rule

WASHINGTON, D.C. – Today, the Stop the Debt Trap campaign, in conjunction with hundreds of national and local organizations, launched a new public awareness and engagement effort to rein in predatory payday lending. In advance of the expected release tomorrow of the proposed rule on payday, car title and predatory installment loans from the Consumer Financial Protection Bureau (CFPB), the groups today unveiled a website, StopPaydayPredators.org, to provide Americans and consumers affected by payday lending a platform to share their opinions about, and experiences with, payday lending and why predatory lenders must be stopped.

Payday loans are among the most deceptive and predatory forms of credit on the market. Lenders prey on vulnerable people, locating disproportionately in neighborhoods with high populations of people of color, and use bait and switch tactics to trick people into borrowing money at interest levels that, on average, exceed 300 percent annually. With over 12 million people taking out payday loans every year, this is a widespread problem that demands a solution.

StopPaydayPredators.org offers concerned citizens a place to submit a public comment to the CFPB, a key part of the regulatory process. There is also the opportunity to share a personal story about how payday lending has affected them or their loved ones.

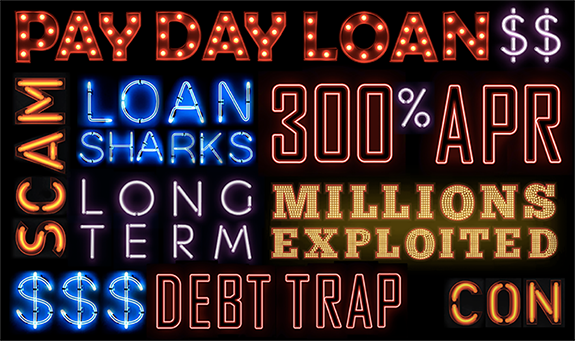

A screenshot from the StopPaydayPredators.org website, highlighting the truth behind payday loans.

“Payday loans are weapons of financial destruction. Payday lenders trap working families in a 400 percent debt trap,” said Aracely Panameño, director of Latino affairs at the Center for Responsible Lending. “We are encouraged that the Consumer Financial Protection Bureau is taking action to protect American families and urge them to eliminate any loopholes in the rule to ensure that these payday lenders can no longer prey on hardworking Americans.”

“What is advertised as a quick financial fix routinely leads into a long-term cycle of debt, in which borrowers pay back more in fees and interest than the amount of the original loan,” said Gynnie Robnett, payday campaign director at Americans for Financial Reform. “The Consumer Financial Protection Bureau needs to hear from the American people about the importance of reining in these predatory practices, and StopPaydayPredators.org will enable people to share their stories.”

The website explains the problem with payday loans and invites visitors to submit a comment.

“For years, communities across the country have worked to rein in the abuses of this predatory industry and have been calling on the CFPB to act,” said Liz Ryan Murray, policy director for National People’s Action. “Today marks the beginning of a new chapter in the fight for fair lending. This website will help lift up American families’ voices to tell the CFPB that we are counting on a strong payday lending rule.”

“Payday lenders have spent tens of millions of dollars currying favor with powerful Washington politicians and they will do whatever it takes to keep their lucrative predatory racket humming along. Just this spring they were caught sending boxes of fake letters to Arizona lawmakers who were considering payday lending legislation at the time,” said Karl Frisch, executive director of Allied Progress. “That is why it is so important that the Consumer Financial Protection Bureau hears from real Americans. We all know someone who has been trapped in the payday lending debt cycle. We owe it to them to make sure the CFPB knows we want the worst abuses of this predatory industry ended once and for all. StopPaydayPredators.org will help us all make our voices heard.”

In addition to launching StopPaydayPredators.org, the Stop The Debt Trap campaign will also launch an engagement campaign throughout the comment collection period – including organizing in Washington, D.C., holding press events, and advertising – to encourage consumers to share their stories and add their voices to the movement to stop payday predators. Americans for Financial Reform, Center for Responsible Lending, National People’s Action, NCLR, the Leadership Conference for Civil and Human Rights, PICO, NAACP, Consumer Federation of America, and Allied Progress are among the hundreds of groups launching this site and will mobilize their members to take action.

###

The Stop The Debt Trap campaign is comprised of over 500 civil rights, consumer, labor, faith, veterans, seniors, and community organizations from all 50 states, including Americans for Financial Reform, the Center for Responsible Lending, National People’s Action, NCLR, the Leadership Conference for Civil and Human Rights, PICO, NAACP, the Consumer Federation of America, and Allied Progress. The campaign works to urge the Consumer Financial Protection Bureau to put rules in place to effectively stop the debt trap. Payday, car title, and high cost installment loans, with annual rates of 300 percent or more, dig borrowers into a dangerous hole of debt. The campaign believes it’s time to end the scam and put rules in place that will end these abusive practices. The StopPaydayPredators.org website is a project of the Stop the Debt Trap campaign. Check Facebook and Twitter for updates.