Debbie Wasserman Schultz Struggles Under Tough Media Questioning Over Support for Payday Lenders

Huh?! Rep. Debbie Wasserman Schultz Nonsensically Claims Florida “Could Certainly Have Better” Consumer Protections Against Payday Lenders… But CFPB Should Use Florida as a Model for Other States… But Only for a Period of Two Years Before Issuing Stronger Protections

Wasserman Schultz: “This bill simply says, you know what Consumer Financial Protection Bureau, take a look at laws like Florida’s. Let’s push the pause button. Let’s let there be a little bit of catch up so we can have other states that don’t have as good of protections as we do–I mean we could certainly have better–but let’s let those states catch up to Florida. And then once that two-year period is over then go ahead and implement those rules.” [Facing South Florida, CBS Miami, 4/10/16]

Rhetoric: Debbie Wasserman Schulz Claimed Florida Payday Loan Regulations Strengthened the Ability of People to Get out Cycle of Debt

Wasserman Schultz: “15 years ago, in Florida when I was a State Senator we passed legislation unanimously– Democrats and Republicans– that really rolled back the horrific practices that the Orlando Sentinel, which won a Pulitzer Prize, exposed; that really were abusive to consumers and they were much higher interest rates than we have today. People did get caught in a debt trap cycle. Now because of the changes we made, people can only take one loan at a time, they can’t use their car title as collateral, they can’t pay off a loan with a new loan. We made sure that components like that of consumer protection strengthened the ability of people to get out of that cycle of debt.” [Facing South Florida, CBS Miami, 4/10/16]

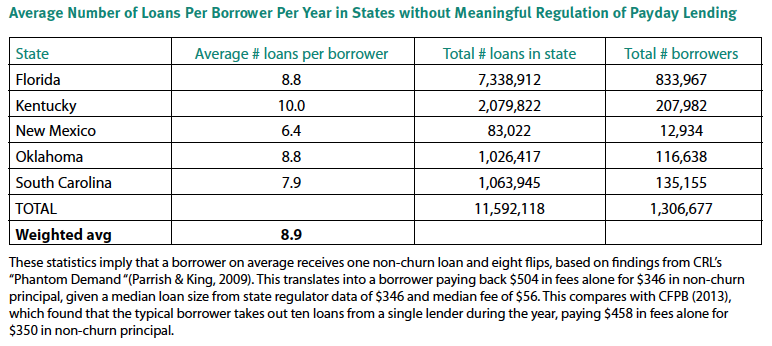

Reality: Florida Payday Loan Consumers Are Still Trapped in a Cycle of Debt Averaging Almost 9 Loans Per Year and One Third Taking Out 12 or More Per Year

[Center for Responsible Lending, 9/13]

32.7% Of Florida Payday Loan Customers Took Out 12 Loans or More Per Year. [Veritec Solutions Report for The Florida Office of Financial Regulation, 5/12]

Rhetoric: Debbie Wasserman Schultz Downplayed Her Role in Legislation That Would Gut the CFPB’s Payday Lending Rule by Using Florida as a Model of Regulation

Wasserman Schultz: First of all, it’s a bill that I am a cosponsor of. Patrick Murphy and Dennis Ross are the lead sponsors of that legislation. [Facing South Florida, CBS Miami, 4/10/16]

Reality: According to Leaked Memo, Wasserman Schultz Has Been Attempting to Gin up Democratic Support for the Bill

Wasserman Schultz Was “Attempting to Gin Up Democratic Support” For Bill She Cosponsored to Gut CFPB Payday Loan Regulations, According to Leaked Memo. “Wasserman Schultz is co-sponsoring a new bill that would gut the CFPB’s forthcoming payday loan regulations. She’s also attempting to gin up Democratic support for the legislation on Capitol Hill, according to a memo obtained by The Huffington Post.” [Huffington Post, 3/1/16]

Rhetoric: Debbie Wasserman Schultz Said the Payday Bill She Cosponsored “Would Not” Block the CFPB from Putting in Regulations to Protect Consumers Against Predatory Payday Lenders

Wasserman Schultz: “This bill would essentially block the Consumer Financial Protection Bureau from putting in regulations that would protect consumers against predatory pay loan practices. DWS: No it would not do that.” [Facing South Florida, CBS Miami, 4/10/16]

Reality: But in the Same Interview, Wasserman Schultz Admitted Bill Would “Push the Pause Button” on CFPB Regulations for Payday Lending for at Least Two Years

Wasserman Schultz: “This bill simply says, you know what Consumer Financial Protection Bureau, take a look at laws like Florida’s. Let’s push the pause button. Let’s let there be a little bit of catch up so we can have other states that don’t have as good of protections as we do–I mean we could certainly have better–but let’s let those states catch up to Florida. And then once that two-year period is over then go ahead and implement those rules.” [Facing South Florida, CBS Miami, 4/10/16]

Rhetoric: Debbie Wasserman Schultz Defends ‘Florida Model’ by Saying There Are Few Complaints Against Payday Lenders in the State

Wasserman Schultz: “There is a reason that only we have a very small percentage of consumer complaints against payday lenders in Florida. Because the changes in the law worked.” [Facing South Florida, CBS Miami, 4/10/16]

Reality: Non-Payday Lender Funded Study Shows That Majority of Payday Loan Consumers Feel Taken Advantage of by Payday Lenders and Nearly 3/4s of Borrowers Support More Regulation of the Industry

55% Of Payday Loan Consumers Feel Payday Loans Take Advantage of Borrowers. [Pew Charitable Trust: “How Borrowers Choose and Repay Payday Loans”, 2/13]

72% Of Payday Borrowers Favor More Regulation of the Industry. [Pew Charitable Trust: “How Borrowers Choose and Repay Payday Loans”, 2/13]

Rhetoric: Debbie Wasserman Schultz Claims Payday Loans Are Needed for Access to Capital

Wasserman Schultz: “Payday lending is unfortunately a necessary component of how people get access to capital that are the working poor.” [Facing South Florida, CBS Miami, 4/10/16]

Reality: 81% of Payday Loan Borrowers Said They Would Simply Cut Back Expenses If Payday Loans Weren’t an Option

Pew Study: 81% Of Payday Borrowers Say They Would Cut Back On Expenses If Payday Loans Were Unavailable. “Even though most borrowers use payday loans for recurring expenses, rather than for emergencies, survey respondents indicated they would use a variety of options to deal with those needs if payday loans were no longer available. In general, borrowers are more likely to choose options—such as adjusting their budgets, delaying bills, selling or pawning personal items, or borrowing from family or friends—that do not connect them to a formal institution. Eighty-one percent of payday borrowers say they would cut back on expenses if payday loans were unavailable.” [Pew Charitable Trusts, 7/12]