Latest “Protect America’s Consumers” Ads Targeting Senators Riddled with Misinformation

Today, Protect America’s Consumers released a new round of misleading advertisements targeting Senators Heidi Heitkamp (D-ND), Jon Tester (D-MT), Joe Donnelly (D-IN), and Joe Manchin (D-WV). Like the shadowy astroturf group’s website, the ads are riddled with misinformation and distortions. But what else would you expect from an industry-backed organization represented by a guy whose previous group was “caught feigning a grassroots campaign, including sending forged letters to congressional offices”?

RHETORIC: “The CFPB Is One of the Only Agencies That Does Not Have to Answer to Congress. The Agencies Managers Do Whatever They Want with Your Tax Dollars Because They Answer to No One.”

REALITY: The CFPB Doesn’t Cost Taxpayers a Dime Because Its Funded Through the Federal Reserve

The CFPB Is Funded by The Federal Reserve, And Is Therefore Not Subject to The Congressional Appropriations Process. “Republicans and Democrats on Capitol Hill continue to fight over whether the new Consumer Financial Protection Bureau should be subject to the congressional appropriations process — that is, whether Congress should directly control how much money the fledgling agency can spend each year. In the meantime, the CFPB funds itself through a bank account at the New York Fed. Under the Dodd-Frank law, the CFPB gets its money from transfers from the Federal Reserve System, up to specific caps set by the law. The Fed can’t turn down requests under that cap.” [Wall Street Journal, 2/15/12]

- The Federal Reserve Is Self-Financed Through the Income On Securities Such as Government Bonds, So It Doesn’t Cost the Taxpayers Anything. [Bloomberg, 7/10/14]

REALITY: Congress Can Hold Hearings On The CFPB Budget

Cordray Pointed Out That the Fact That Congress Can Hold Hearings to Examine The CFPB Budget Is Meaningful Oversight Against Frivolous Spending. “Yet Cordray pointed out that Congress is permitted to hold hearings to examine the budget of the bureau, and said that oversight would make it impossible to spend frivolously. “The notion that we would spend $100 million on paper clips and it wouldn’t matter, that we can be brought up here in front of you and have to answer for that publicly and embarrass ourselves if it turns out we were engaged in frivolous expenditures, that is very meaningful oversight,” according to Cordray. [MarketWatch, 2/15/12]

RHETORIC: “Managers Set Their Own Salaries”

REALITY: The CFPB Compensates Employees in Line with Federal Reserve Employees, As Required by Law

The CFPB Is Required by Law to Compensate Employees in Line with The Federal Reserve Board’s Average Salary for Employees with Similar Skills and Experience. “The CFPB responded to the revelations by noting the Dodd-Frank bill, which created the agency itself in 2011, requires that compensation be comparable to Federal Reserve employees. “CFPB’s pay design and pay setting methodology places our employees in line with the Federal Reserve Board’s average salary for employees with similar skills and experience,” spokeswoman Michelle Person told The Daily Caller.” [Daily Caller, 7/18/13]

Consumer Protection Expert: “I Have No Quarrel Whatsoever with The CFPB’s Salary Structure…They Need to Pay the Salaries They Do in Order to Attract Top-Notch Talent.” “Consumer protection expert Alan Kaplinsky told TheDC the high compensation of CFPB employees is nothing unusual. “I have no quarrel whatsoever with the CFPB’s salary structure,” said Kaplinsky, chair of the Consumer Financial Services Group. “They need to pay the salaries they do in order to attract top-notch talent.” [Daily Caller, 7/18/13]

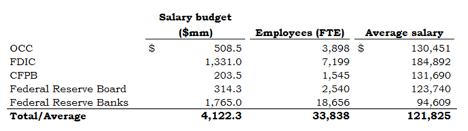

REALITY: CFPB Employee Salaries Are In-Line with Other Federal Banking Regulators, And Far Less Than The FDIC

[Bloomberg View, “Are Bank Regulators Overpaid?”, 4/22/14]

RHETORIC: “Use Your Tax Dollars to Build the Most Lavish Office in DC”

REALITY: The CFPB Renovation Won’t Cost Taxpayers a Dime

The Renovation for The CFPB Will Cost Taxpayers “Precisely Zero” Since Its Paid for by The Federal Reserve Which “Is Self-Financed, Largely with Income On Securities Such as Government Bonds.” “Republicans have cast the project as a misuse of public dollars in a time of tight budgets. “The CFPB is funded by the Federal Reserve, which happens to be taxpayer money,” Hensarling said in a February speech that denounced the renovation. But the Federal Reserve is self-financed, largely with income on securities such as government bonds, so the amount Congress needs to set aside for the office redo is precisely zero.” [Bloomberg, 7/10/14]

REALITY: Protect America’s Consumers Wildly Overestimates the Cost of the Renovation, Which Is in Line with Other Government Renovation Projects

Bloomberg: The GOP Estimated That The CFPB Headquarters Renovation Would Cost $216 Million but “Their Numbers Don’t Add Up.” “The GOP members say their calculations show the renovation will cost $215.8 million, or $590 per square foot—more than double the CFPB estimate, and more than it cost per square foot to construct the lavish Bellagio Hotel and Casino in Las Vegas. These figures were picked up by newspapers and conservative websites, which ran them under headlines like “Elizabeth Warren’s Brainchild Builds HQ Costlier Than Trump Tower.” There’s just one hitch: Their numbers don’t add up.” [Bloomberg, 7/10/14]

- The Inspector General of the Federal Reserve Estimated the Cost of the Renovations at $145.1 Million. “At McHenry’s request, the inspector general of the Federal Reserve, the CFPB’s parent agency, prepared a report in June examining the project’s price tag. It said the job would cost an estimated $145.1 million for construction, construction management, and GSA fees. The report said the renovation covers 512,000 sq. ft., bringing the estimate to $283 per square foot. The renovation has since been scaled back to 503,000 sq. ft.” [Bloomberg, 7/10/14]

The GSA Has Said the Costs Are in Line with Other Government Renovation Projects and The CFPB Followed Proper Contracting Procedures. “The GSA has said the costs are in line with other government renovation projects, and the inspector general concluded the CFPB followed proper contracting procedures.” [Bloomberg, 7/10/14]