Reality Check: Lobbyist Misleads Readers in Op-Ed on Florida’s Weak Payday Lending Laws

RHETORIC: Business Lobbyist Claims Florida Has Strong Payday Lending Laws

“Florida lawmakers, including Democratic National Committee Chair Debbie Wasserman Schultz, have signed onto legislation that would delay the implementation of the CFPB’s payday loan rules for two years and exempt states like Florida that already have strong payday loan laws on the books from implementing the CFPB’s federal standard. The legislation, the Consumer Protection and Choice Act, balances both the need to regulate short-term lenders and the desire to preserve access to credit for low-income borrowers.” [Sun Sentinel: Barney Bishop Op-Ed “Protecting Vulnerable Borrowers, Consumers Is a Bipartisan Issue,” 4/5/2016]

Bishop Has Been Called a “Business Lobbyist Icon.” Bishop’s company website notes that a state newspaper in Florida has described him as “a business lobbyist icon.” [Barney Bishop Consulting, LLC Website Accessed 4/6/2016]

REALITY: The Florida Model Is a Payday Lender’s Dream: Riddled with Loopholes and Massive Interest Rates. Average Borrower Takes Out 9 Loans.

Payday Lenders in Florida Claimed They Were Credit Service Organizations Not Subject to Florida’s Payday Lending Law.

“Last year, the state Office of Financial Regulation began looking into the practices of EZMoney and Cash America, two Texas-based chains that claim to be “credit-service organizations” not subject to Florida’s payday-loan law. “We’re in the early, fact-finding stages with both of them,” said Ramsden, the agency administrator. “We are aware they’re citing Florida’s credit-service organization law, which was intended to help consumer-credit agencies. In this situation, however, we have payday lenders using it to broker payday loans.” [Orlando Sentinel, “Some Payday Lenders Are Flouting Florida’s Reform Law”4/1/2007]

Payday Lenders Claim They Aren’t Subject to Florida’s Payday Lending Law Because They Don’t Receive a Post-dated Check but Rather a Promissory Note That Allows Them to Automatically Withdraw Funds from the Customer’s Bank Account.

“Here’s their argument: The state’s payday law pertains only to lenders that require customers to give them a postdated check written for the amount owed. When the loan comes due, the lender simply cashes the check. But Cash America and EZMoney require no such check — only a promissory note that authorizes the lender to automatically withdraw the money from the customer’s bank account.” [Orlando Sentinel, “Some Payday Lenders Are Flouting Florida’s Reform Law”4/1/2007]

A Typical Payday Loan in Florida Charges 304% Apr, and Most Florida Payday Loan Customers Take Out Nine Payday Loans a Year.

“Data compiled by the nonpartisan Pew Charitable Trusts is similarly dismal. A typical Florida payday loan customer ends up taking out nine payday loans a year and is stuck in debt for nearly half of that year, according to Pew. The average interest rate on Florida’s payday loans is 304 percent — only slightly better than the 390 percent annual average. Critically, the average payday loan amount of $389 is equal to 35 percent of average paychecks in the state — in line with national figures.” [Huffington Post: “DNC Chair Joins GOP Attack On Elizabeth Warren’s Agency”, 3/1/2016]

Check Into Cash Advertises a Payday Loan with an APR of 391.07% In Florida. [Check Into Cash Website, Access 3/8/2016]

Amscot Financial Advertises Payday Loan Rates as High as 312.86%. [Amscot Financial Website, Accessed 3/8/2016]

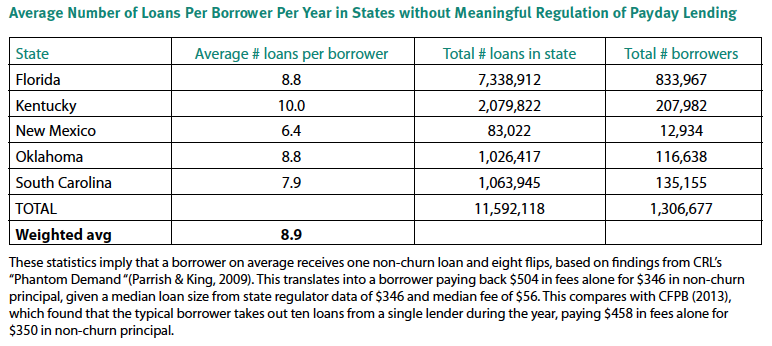

In Florida, There Are Frequent Rollovers With the Average Borrower Taking Out 8.8 Loans Per Year and Almost a Third of Borrowers Taking Out 12 or More Per Year

[Center For Responsible Lending, “Payday Lending Abuses and Predatory Practices” 09/2013]

32.7% of Florida Payday Loan Customers Took Out 12 Loans or More Per Year. [Veritec Solutions Report for The Florida Office of Financial Regulation, May 2012]