Get the Facts on Wells Fargo and CEO Tim Sloan

Contents:

-

Tim Sloan’s annual pay increase

-

Tim Sloan’s authorization of billions in stock buybacks to enrich investors

-

Tim Sloan’s multimillion-dollar residences

-

Wells Fargo exposed for opening millions of fake accounts

-

Tim Sloan’s involvement in Wells Fargo’s aggressive and predatory sales culture, years before the fake account scandal broke

-

Wells Fargo’s continued aggressive sales culture

-

Wells Fargo’s payment of over $4 billion in fines and settlements for abusing consumers since its fake account scandal was exposed

Wells Fargo CEO Tim Sloan’s Annual Pay Increased By Over $9 Million While He Had A “Front-Row Seat” To Wells Fargo’s Aggressive Sales Culture

From 2011 To 2017, Tim Sloan’s Annual Pay Increased From Over $8.3 Million To Over $17.5 Million.

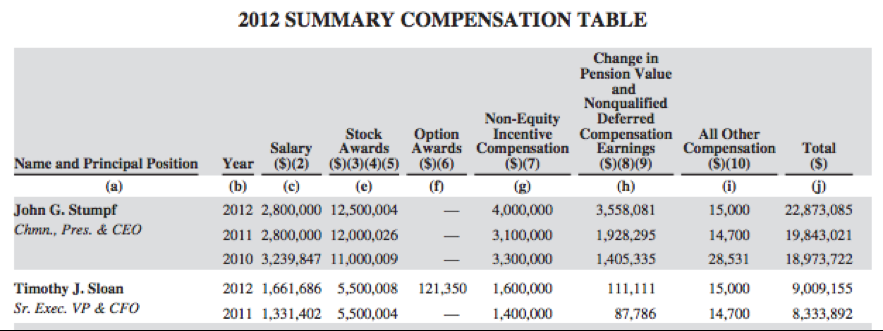

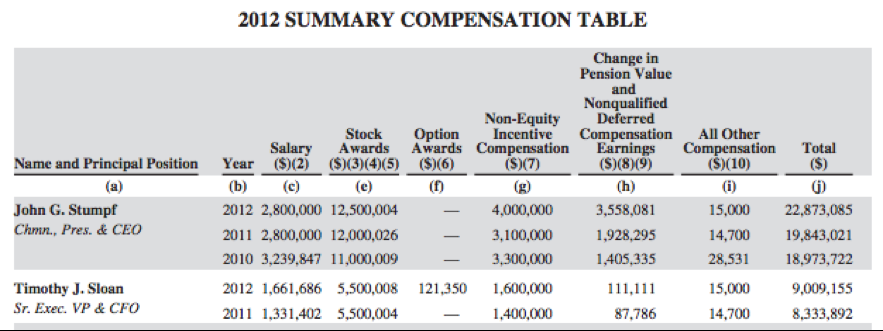

In 2011, Tim Sloan Made Over $8.3 Million As A Senior Executive Vice President And CFO Of Wells Fargo.

In 2011, Tim Sloan Made $8,333,892 As A Senior Executive Vice President and CFO Of Wells Fargo. [Wells Fargo 2013 Proxy Statement, Wells Fargo, 03/14/13]

In 2012, Tim Sloan Made Over $9 Million As A Senior Executive Vice President And CFO Of Wells Fargo.

In 2012, Tim Sloan Made $9,009,155 As A Senior Executive Vice President and CFO Of Wells Fargo. [Wells Fargo 2013 Proxy Statement, Wells Fargo, 03/14/13]

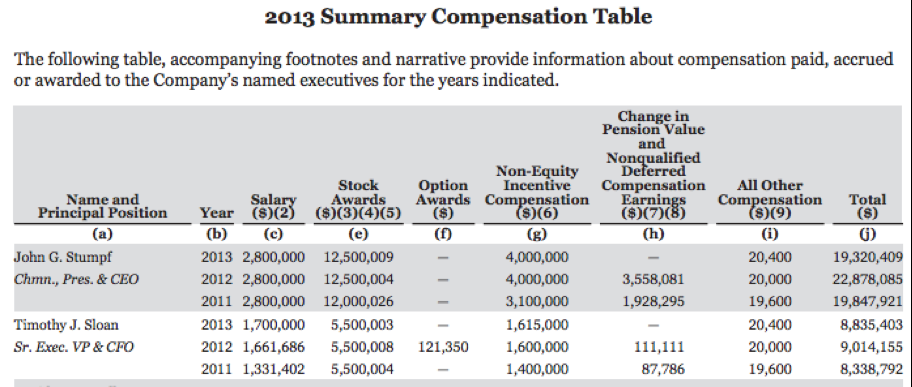

In 2013, Tim Sloan Made Over $8.8 Million As A Senior Executive Vice President And CFO Of Wells Fargo.

In 2013, Tim Sloan Made $8,835,403 As A Senior Executive Vice President And CFO Of Wells Fargo. [Wells Fargo 2014 Proxy Statement, Wells Fargo, 03/18/14]

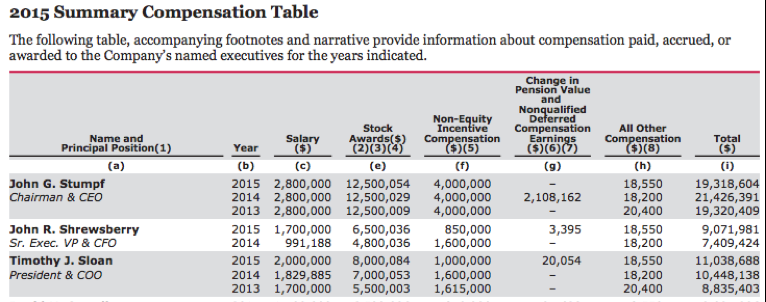

In 2014, Tim Sloan Made Over $10.4 Million As A Senior Executive Vice President Of Wells Fargo.

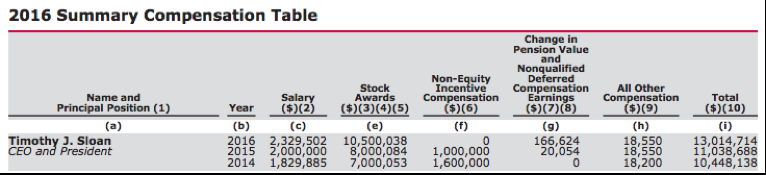

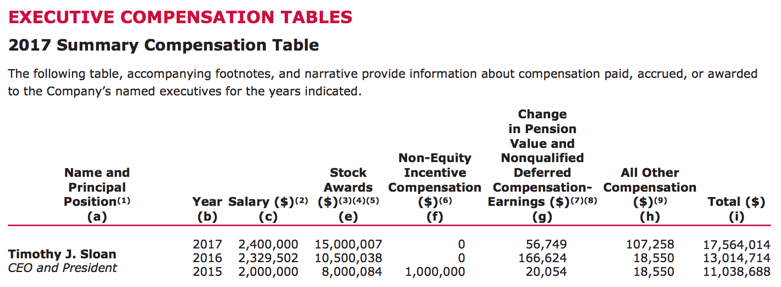

In 2014, Tim Sloan Made $10,448,138 As A Senior Executive Vice President Of Wells Fargo. [Wells Fargo 2015 Proxy Statement, Wells Fargo, 03/17/15]

In 2015, Tim Sloan Made Over $11 Million As President And COO Of Wells Fargo.

In 2015, Tim Sloan Made $11,038,688 As President And COO Of Wells Fargo. [Wells Fargo 2016 Proxy Statement, Wells Fargo, 03/16/16]

In 2016, Tim Sloan Made Over $13 Million As President And COO And Then CEO Of Wells Fargo.

In 2016, Tim Sloan Made $13,014,714 As President And COO And Then CEO Of Wells Fargo. [Wells Fargo 2017 Proxy Statement, Wells Fargo, 03/15/17]

- Tim Sloan Was Chief Operating Officer For Most Of 2016, Until He Became President And CEO In October Of That Year. “Timothy (Tim) J. Sloan was elected chief executive officer of Wells Fargo & Company and a member of the Board of Directors in October 2016. He became president in November 2015. Previously he served as chief operating officer from November 2015 to October 2016.” [“Timothy J. Sloan,” Wells Fargo, accessed 03/06/19]

In 2017, Tim Sloan Made Over $17.5 Million As President And CEO Of Wells Fargo.

In 2017, Tim Sloan Made $17,564,014 As President And CEO Of Wells Fargo. [“Wells Fargo 2018 Proxy Statement,” Wells Fargo, 03/14/18]

Tim Sloan Had A “Front-Row Seat” To Wells Fargo’s “Troubling Sales Practices” For Years Before The Fake Account Scandal Erupted.

Tim Sloan Admitted He Was Aware Of Wells Fargo’s “Troubling Sales Practices” As Early As 2013.

Tim Sloan Admitted He Was Aware Of Wells Fargo’s “Troubling Sales Practices” As Early As 2013. “He has said he was aware of the troubling sales practices as early as late 2013 […]” [James Rufus Koren, “CEO Tim Sloan has had two years to fix Wells Fargo. Is he running out of time?,” The Los Angeles Times, 11/25/18]

Tim Sloan Had A “Front-Row Seat To Top Executives’ Deliberations Over Management Issues” For Years Before The Fake Account Scandal…

For Years Before The Scandal, Tim Sloan Had A “Front-Row Seat To Top Executives’ Deliberations Over Management Issues, Strategy And Handling Risks.” “He also has sat for years on the company’s operating committee, giving him a front-row seat to top executives’ deliberations over management issues, strategy and handling risks.” [Dakin Campbell, “The Man Who May Inherit the Mess at Wells Fargo,” Bloomberg, 09/23/16]

…And Federal Investigators Argued That Those Executives Knew About Wells Fargo’s Problems For A Decade.

“Federal Investigators Alleged Executives Knew About The Problem For A Decade.” [Laura J. Keller and Shahien Nasiripour, “Does Wells Fargo Have a Plan?,” Bloomberg, 03/01/18]

Tim Sloan Directly Supervised The Head Of The Unit Responsible For Opening Unauthorized Accounts.

The Head Of The Unit Responsible For Opening Unauthorized Accounts Reported Directly To Timothy Sloan Once He Became Wells Fargo’s COO.

Carrie Tolstedt, The Executive In Charge Of The Unit Responsible For The Fraudulent Account Activity, Reported Directly To Sloan In The Time Before The Scandal Became Public. “Sloan said Tuesday on CNBC that Carrie Tolstedt, who led the bank’s community banking unit where the misconduct occurred, reported directly to him when he became the chief operating officer late last year.” [Jonnelle Marte, “What we know about Tim Sloan, the new CEO of Wells Fargo,” The Washington Post, 10/13/16]

- Sloan Became Tolstedt’s Boss In November 2015, When He Became Wells Fargo’s Chief Operating Officer. “In November 2015 Sloan became Tolstedt’s boss, when his new role as COO and president gave him oversight of her community banking division.” [Dakin Campbell, “The Man Who May Inherit the Mess at Wells Fargo,” Bloomberg, 09/23/16]

As Early As 2014, Tim Sloan Bragged About The Profit-Making Potential Of Wells Fargo’s Aggressive Cross-Selling Practices, Which Helped Make It The “World’s Most Valuable Bank” Following The Financial Crisis.

Tim Sloan Bragged About Wells Fargo’s Cross-Selling Practices, Which Helped It Become One Of Only Six Public American Companies To Make More Than $10 Billion In Profits Since 2010.

In 2014, Tim Sloan “Touted The Bank’s Ability To Sell More To Every Customer.” “As a senior executive, Sloan, too, touted the bank’s ability to sell more to every customer. ‘The more that we cross-sell, the more revenue grows,’ he said in May 2014.” [Laura J. Keller and Shahien Nasiripour, “Does Wells Fargo Have a Plan?,” Bloomberg, 03/01/18]

Wells Fargo’s Cross-Selling Strategy—”Getting Customers To Sign On To Multiple Products, From Checking To Mortgages To Credit Cards”—Helped Make It “One Of Only Six Publicly Traded U.S. Companies To Have Generated More Than $10 Billion In Annual Profit Since 2010,” Alongside Apple. Wells Fargo was “one of only six publicly traded U.S. companies to have generated more than $10 billion in annual profit since 2010, data compiled by Bloomberg show, putting it in the same league as Apple Inc. Wells Fargo built that long-term record on its legendary ability to sell. Calling its branches stores, executives focused on cross-selling—getting customers to sign on to multiple products, from checking to mortgages to credit cards.” [Laura J. Keller and Shahien Nasiripour, “Does Wells Fargo Have a Plan?,” Bloomberg, 03/01/18]

Wall Street “Loved” The Cross-Selling Strategy, And Wells Fargo Eventually Became The “World’s Most Valuable Bank” Following The Financial Crisis. “Calling its branches stores, executives focused on cross-selling—getting customers to sign on to multiple products, from checking to mortgages to credit cards. […] Wall Street loved it, and for a few years after the financial crisis, Wells Fargo was the world’s most valuable bank. (Now it’s No. 4. [as of March 2018])” [Laura J. Keller and Shahien Nasiripour, “Does Wells Fargo Have a Plan?,” Bloomberg, 03/01/18]

Three Months Before The Fake Account Scandal Erupted, Tim Sloan Did Not Believe That Wells Fargo’s Sales Tactics Were Problematic And Even Claimed They Were Executed “Correctly, And Appropriately.”

Tim Sloan Was Asked If Their Sales Cross-Selling Strategy Had Been Pushed To The Limit And He Said “No.”

Tim Sloan Flatly Said “No” When Asked If He Believed That Wells Fargo’s Sales Tactics Had Been Pushed To The Limit. Sloan was asked, “On the topic of cross-selling […] Is there any sense that the bank has pushed that strategy to the limit?” Sloan replied, “No. Because when you think of our vision, it’s to satisfy our customers’ financial needs, and to help them succeed financially. We know a lot about our customers, and so doesn’t it make sense that we would use our data and match it with our product set to try to broaden our relationship with our customer?” [Kristin Broughton and Robert Barba, “Picking the Brain of Wells Fargo’s (Likely) Next CEO,” American Banker, 06/16/16]

Tim Sloan Claimed There Was No Problem With Wells Fargo’s “Fundamental Strategy” Of Cross-Selling And That The Company Made Sure To “Do It Correctly, And Appropriately.”

Tim Sloan Claimed There Was No Problem With Wells Fargo’s “Fundamental Strategy” Of Cross-Selling And That The Company Made Sure To “Do It Correctly, And Appropriately.” “How we do it, how we talk about it, making sure that we do it correctly, and appropriately – and making sure we follow regulations – that will continue to evolve. But the fundamental strategy that we have is not going to change.” [Kristin Broughton and Robert Barba, “Picking the Brain of Wells Fargo’s (Likely) Next CEO,” American Banker, 06/16/16]

Wells Fargo CEO Tim Sloan Authorized $40.6 Billion In Stock Buybacks To Enrich Investors—While Holding Over $64 Million In Company Stock, Keeping Bank Employees’ Wages Low, And Cutting 26,500 Jobs.

Wells Fargo Will Profit More From Trump’s Tax Cuts Than Any Other Big Bank—And The Company Will Put Its Huge Windfall Toward $40.6 Billion In Stock Buybacks For Executives And Shareholders.

The Country’s Biggest Banks Stand To Gain An Average Of 14% Increased Earnings From Trump’s Massive Corporate Tax Cut—But Wells Fargo Stands To Make Even More—18%.

According To An Analysis By Goldman Sachs, Wells Fargo Will Profit From Donald Trump’s Tax Bill More Than Any Of The Other Biggest Banks In The Country. “Some of Wall Street’s largest banks stand to win big from the tax bill now hurtling its way towards the president’s desk — but among them, Wells Fargo will make out the best. That’s according to an analysis released Monday by the equity research team at Goldman Sachs, which ran the numbers from the compromise measure that was revealed by Congress on Friday.” [Lydia DePillis, “Why Wells Fargo could be one of tax reform’s big winners,” CNN, 12/18/17]

- The Plan’s Massive Corporate Tax Cut Gave The Seven Biggest Banks “An Average 14% Increase In Earnings” With Wells Fargo “Mak[ing] Out The Best, With An 18% Boost, In Large Part Because It Derives Nearly All Of Its Profits From The United States.” “The bill, which could be enacted within days, will give the country’s seven largest banks — not including Goldman itself — an average 14% increase in earnings, Goldman found. That’s because of the plan’s big cut in the corporate tax rate — from 35% to 21%. Wells Fargo would make out the best, with an 18% boost, in large part because it derives nearly all of its profits from the United States, Goldman said.” [Lydia DePillis, “Why Wells Fargo could be one of tax reform’s big winners,” CNN, 12/18/17]

- Trump Signed The Tax Bill Into Law In December 2017. “President Trump on Friday signed the most significant overhaul of the U.S. tax code in 30 years, delivering on a pledge to finish work on the long-standing Republican priority by Christmas. Trump signed the $1.5 trillion measure in the Oval Office shortly before he was scheduled to head to his Mar-a-Lago resort in Florida for the holidays.” [John Wagner, “Trump signs sweeping tax bill into law,” The Washington Post, 12/22/17]

After Trump’s Tax Bill Passed, Wells Fargo Authorized $40.6 Billion In Stock Buybacks To Enrich Its Executives And Shareholders.

After Donald Trump’s Tax Bill Was Passed, Wells Fargo Authorized $40.6 Billion In Stock Buybacks To Enrich Executives And Shareholders. “Wells Fargo has authorized $40.6 billion in stock buybacks since Trump’s tax bill was passed, with two new authorizations of 350 million shares in January and October 2018. What about actual spending? In the first nine months of the year, Wells spent $8.2 billion on repurchasing their own stock (in the first quarter of 2018, they spent $3 billion; in the second quarter they spent $2 billion; in the third quarter, Wells spent $3.2 billion on actual share repurchases). These are all funds that could have been invested in the workforce, rather than enriching top executives and shareholders who know when to sell.” [Lenore Palladino, “What Wells Fargo’s $40.6 Billion in Stock Buybacks Could Have Meant for Its Employees and Customers,” Roosevelt Institute, 11/07/18]

- Stock Buybacks “Reward Shareholders—Which Often Include Executives Themselves—By Raising The Price Of Shares.” “When a share of stock is bought back, the company reabsorbs that portion of its ownership that was previously distributed among other investors. This reduces the number of outstanding shares in the market, resulting in an increase in the price per share. The purpose of stock buybacks is to reward shareholders—which often include executives themselves—by raising the price of shares.” [Lenore Palladino, “What Wells Fargo’s $40.6 Billion in Stock Buybacks Could Have Meant for Its Employees and Customers,” Roosevelt Institute, 11/07/18]

Before Trump’s Tax Cut Passed, Wells Fargo Was Planning A Smaller $33 Billion Shareholder Gift—Which Would Have Already Set A Record For Any U.S. Bank.

In Mid-2018, Wells Fargo Was Planning To Return Nearly $33 Billion To Shareholders, “A Record For Any U.S. Bank.” “Wells Fargo is looking to return almost $33 billion in cash to shareholders over the next twelve months – a record for any U.S. bank, and slightly better than the $31.5 billion capital return plan posted by its larger peer JPMorgan after the Fed released results for the annual stress test for banks […] Taken together with the new $24.5 billion share buyback program, this equals the record $32.8 billion payout.” [“Wells Fargo’s $33 Billion Capital Return Plan Is A New Record For U.S. Banks,” Forbes, 07/05/18]

- The Year Before, Wells Fargo Planned To Reward Shareholders With Only $19 Billion, Or 73% Less Than Its 2018 Figure. “Notably, this represents a 73% jump compared to the bank’s plan to return $19 billion last year.” [“Wells Fargo’s $33 Billion Capital Return Plan Is A New Record For U.S. Banks,” Forbes, 07/05/18]

Wells Fargo CEO Tim Sloan Held Over $64 Million In Wells Fargo Stock When He Pledged To Dole Out Any “Excess Amount Of Capital” To Shareholders.

In February 2018, Wells Fargo CEO Tim Sloan Owned $64,491,281.24 In Wells Fargo Stock.

As Of February 22, 2018, Tim Sloan Owned 1,096,604 Shares of Wells Fargo Stock. [Wells Fargo & Co. Securities and Exchange Commission Form DEF 14A, 04/24/18]

[…]

![]()

As Of February 22, 2018, Wells Fargo’s Closing Stock Price Was $58.81. [Historical Stock Quote for Wells Fargo & Co., MarketWatch, 02/22/18, accessed 03/05/19]

In February 2018, Tim Sloan Held Nearly 25% Of The Stock Held By All Of Wells Fargo’s Directors, Executives, And Officers – And He Held Well Over 500,000 More Shares Than The Bank’s Next-Largest Executive Shareholder.

As of February 22, 2018, Tim Sloan Owned 1,096,604 Shares of Wells Fargo Stock. [Wells Fargo & Co. Securities and Exchange Commission Form DEF 14A, 04/24/18]

[…]

![]()

As of February 22, 2018, “All Directors, Named Executives, And Executive Officers As A Group (26 Persons),” Including Tim Sloan, Owned 4,387,928 Shares Of Wells Fargo Stock. [Wells Fargo & Co. Securities and Exchange Commission Form DEF 14A, 04/24/18]

[…]

![]()

The Next Highest Wells Fargo Stockholder Among The Directors, Executives, And Officers Was Avid Modjtabai, Who Held 585,203 Shares As Of February 22, 2018. [Wells Fargo & Co. Securities and Exchange Commission Form DEF 14A, 04/24/18]

[…]

![]()

Tim Sloan Highlighted Wells Fargo’s “Excess Of Amount Of Capital” And Pledged To Increase Stock Buybacks For Shareholders In The Coming Years.

In 2017, Tim Sloan Said That Wells Fargo Would “Increase Our Dividend And Our Share Buybacks” With The Bank’s “Excess Amount Of Capital.” “At an investor presentation in 2017, Wells Fargo CEO Timothy Sloan made clear his expectations that the company’s buybacks program would continue in the coming years: ‘Is it our goal to increase return to our shareholders and do we have an excess amount of capital? The answer to both is, yes,’ Sloan said. ‘So our expectation should be that we will continue to increase our dividend and our share buybacks next year and the year after that and the year after that.’” [Lenore Palladino, “What Wells Fargo’s $40.6 Billion in Stock Buybacks Could Have Meant for Its Employees and Customers,” Roosevelt Institute, 11/07/18]

In 2018, When Asked About Buybacks For Shareholders, Tim Sloan Said That Wells Fargo Had “An Excess Amount Of Capital” And That The Bank Planned “Reduce That Excess Over The Next Two To Three Years.” When asked about “near-term buyback plans or dividends” on an earnings call, Tim Sloan said that Wells Fargo had “an excess amount of capital to run and grow Wells Fargo” and that the company planned “to reduce that excess over the next two to three years. That’s where we’re going.” [“Wells Fargo & Company (WFC) Earnings Conference Call Transcript,” The Motley Fool, 04/13/18]

Tim Sloan Stands To Get Paid Even More Wells Fargo Stock Incentives—The Bank Paid Him $15 Million In Shares In 2017 Alone.

In 2017, Tim Sloan Was Paid “A Bonus That Included Shares Valued At $15 Million.” “Wells Fargo & Co. awarded Chief Executive Timothy Sloan $17.4 million in compensation for 2017, his first full year leading the embattled bank. Sloan received $2.4 million in base pay, with a bonus that included shares valued at $15 million. He didn’t receive a cash bonus, though other top executives did.” [Emily Glazer, “Wells Fargo CEO made $17.4 million in 2017, 291 times company’s median salary,” MarketPlace, 03/14/18]

Wells Fargo Has A Long-Term Incentive Compensation Plan In Which The Bank Incentivizes “Key Employees And Directors” With “Opportunities For Them To Participate In Stockholder Gains.” “The purpose of the Long-Term Incentive Compensation Plan (the ‘Plan’) is to motivate key employees and directors to produce a superior return to the Company’s stockholders by providing opportunities for them to participate in stockholder gains and by rewarding them for achieving a high level of corporate financial performance.” [“Long-Term Incentive Compensation Plan,” Wells Fargo, 01/01/17]

Meanwhile, Wells Fargo Is Keeping Front-Line Workers’ Wages Near Poverty Levels And Will Cut 26,500 Jobs—10% Of Its Workforce—In The Next Three Years.

Wells Fargo Pays Its Front-Line Workers Low, “Nearly Poverty-Level Wages.”

When Tim Sloan Highlighted The Company’s “Excess Of Capital,” Wells Fargo Was “Laying Off Workers, Outsourcing Jobs, And Continuing To Pay Its Employees Nearly Poverty-Level Wages.” “It is notable that Wells Fargo’s CEO describes the company as having an ‘excess of capital,’ despite the fact that it is laying off workers, outsourcing jobs, and continuing to pay its employees nearly poverty-level wages.” [Lenore Palladino, “What Wells Fargo’s $40.6 Billion in Stock Buybacks Could Have Meant for Its Employees and Customers,” Roosevelt Institute, 11/07/18]

- Despite Wells Fargo’s Commitment To Conduct Itself More Accountably And Ethically, Its Low Employee Pay Has Undermined Its Ability To “Retain A Qualified, Committed Workforce.” “A fair wage for front-line bank workers is a critical part of the improved working conditions required to create an accountable financial institution that Wells Fargo has committed to being. Fair pay for workers helps companies attract and retain a qualified, committed workforce.” [Lenore Palladino, “What Wells Fargo’s $40.6 Billion in Stock Buybacks Could Have Meant for Its Employees and Customers,” Roosevelt Institute, 11/07/18]

If Wells Fargo Were to Evenly Distribute The $40.6 Billion It Has Authorized for Stock Buybacks Among Its 262,700 Employees, Each Employee Would Get $154,000.

The Roosevelt Institute Found That If Wells Fargo Had Not Routed $40.6 Billion To Stock Buybacks For Shareholders, It Could Have Given Each Of Its 262,700 Employees $154,000. “Wells Fargo can certainly afford the level of commitment that their motto, building a better bank, requires. Using data from the S&P Global Compustat database and Wells Fargo’s quarterly filings with the Securities and Exchange Commission (SEC), we calculated that if Wells Fargo divided the $40.6 billion that it has authorized the company to spend on stock buybacks between its 262,700 employees, each employee could have received an astounding $154,000.” [Lenore Palladino, “What Wells Fargo’s $40.6 Billion in Stock Buybacks Could Have Meant for Its Employees and Customers,” Roosevelt Institute, 11/07/18]

In September 2018, Wells Fargo Announced It Would Cut 26,500 Jobs Within The Next Three Years.

In September 2018, Wells Fargo Announced It Would Cut 26,500 Jobs, Which Altogether Would Cost One-Tenth Of The $40.6 Billion Wells Fargo Has Authorized for Buybacks, “Assuming Each Employee Takes Home $100,000 Annually.” “Even worse, since the Trump tax bill, Wells Fargo has announced that the company will eliminate as many as 26,500 positions over a three-year period (through layoffs and attrition). If the company chose to save just one-tenth of the $40.6 billion it has authorized for spending on stock buybacks, all 26,500 of those jobs could have been saved, assuming each employee takes home $100,000 annually.” [Lenore Palladino, “What Wells Fargo’s $40.6 Billion in Stock Buybacks Could Have Meant for Its Employees and Customers,” Roosevelt Institute, 11/07/18]

- The Bank Plans To Lay Off “At Least 10%” Of Its Workforce. “The move marks a headcount reduction of at least 10% by the banking institution, marking a significant decrease in the workforce of the third-largest bank in the U.S.” [Karl Utermohlen, “Wells Fargo Layoffs: Company to Cut 26,000 Jobs,” Investorplace, 09/24/18]

Wells Fargo CEO Tim Sloan Owns A $7.3 Million Mansion In “Lavish” San Marino And A $5.1 Million Beachfront Condo In “Affluent” Montecito, California.

Tim Sloan Owns A $7.3 Million Mansion In “Lavish” San Marino, California, Which Has A Median Home Value Of Over $2.3 Million.

Tim Sloan Owns A $7.3 Million Home In San Marino, California.

Tim Sloan Owns A House In San Marino, California, Which He Bought For $5.15 Million 2007. “Sloan lives in a 5,804 square foot, 8-bedroom Spanish-style mansion […] on a cul-de-sac without sidewalks in upscale San Marino. He purchased the home in 2007 for $5.15 million.” [Peter Dreier, “Putting Names And Faces To The 1 Percent: Wells Fargo’s Tim Sloan,” Huffington Post, 12/02/12]

- Sloan Listed This As His Current Address As Recently As June 14, 2018. [Republican National Committee Schedule A, Federal Election Commission, 06/14/18]

Tim Sloan’s 5,800 Square Foot House Has Eight Bedrooms And Four Bathrooms.

Redfin Estimates The Value Of The Property To Be Over $7.3 Million; The 5,804 Square Foot House Features Eight Bedrooms And Four Bathrooms. “This 5,804 square foot house sits on a 0.89 acre lot and features 8 bedrooms and 4 bathrooms. This property was built in 1926 and last sold for $5,150,000. Based on Redfin’s San Marino data, we estimate the home’s value is $7,360,351.” [Redfin, accessed 03/08/19]

- The Los Angeles County Assessor Lists A “2019 Roll Preparation” Value Of $6,251,723 For The Property. [AIN:5328-021-014, Los Angeles County Assessor Portal, accessed 03/08/19]

[Redfin, accessed 03/08/19]

[AIN: 5328-021-014, Los Angeles County Assessor Portal, accessed 03/08/19]

[AIN: 5328-021-014, Los Angeles County Assessor Portal, accessed 03/08/19]

[AIN: 5328-021-014, Los Angeles County Assessor Portal, accessed 03/08/19]

[AIN: 5328-021-014, Los Angeles County Assessor Portal, accessed 03/08/19]

The Median Home Value In Tim Sloan’s Neighborhood Is Over $2.3 Million—And Is Just $618,900 In The Rest Of His County.

The Median Home Value In San Marino, Where Tim Sloan Lives, Is Over $2.3 Million. “The median home value in San Marino is $2,346,100. San Marino home values have declined -3.9% over the past year and Zillow predicts they will rise 2.4% within the next year.” [“San Marino Home Prices & Values,” Zillow, accessed 03/08/19]

- The Median Home Value In All Of Los Angeles County Is $618,900. “The median home value in Los Angeles County is $618,900.” [“Los Angeles County Home Prices & Values,” Zillow, accessed 03/07819]

San Marino Is A “Lavish” And Exclusive Neighborhood With “A Rare Home There That Lists For Less Than $2 Million.”

The Los Angeles Times Described San Marino As “Just As Lavish” As Beverly Hills And Bel-Air, A Neighborhood “‘Protected By Stringent Zoning Regulations,’” With “A Rare Home There That Lists For Less Than $2 Million.” “Although star-studded neighborhoods such as Beverly Hills and Bel-Air have become symbols for the concentration of extreme wealth in Southern California, there are other neighborhoods here that are just as lavish but keep a low profile. In the San Gabriel Valley, that market is San Marino, which was envisioned as the exclusive domain of the well-to-do from its inception. […] Their philosophy lives, as enshrined on the city’s official website: ‘San Marino was formed to … control the growth and activities of the city’ so that ‘property values will be protected by stringent zoning regulations.’ In that, they’ve been wildly successful. San Marino is the picture of genteel suburbanity; restrictive zoning has resulted in a cohesive environment free of the endless strip malls and stucco McMansions that plague parts of Southern California. And true to their credo, the city’s elected officials have managed growth in such a way as to boost property values to the point where it’s a rare home there that lists for less than $2 million.” [Scott Garner, “Neighborhood Spotlight: San Marino’s exclusivity was always the plan,” Los Angeles Times, 05/23/18]

- Because The Market Lacks Apartments, “Many San Marino Workers Can’t Afford To Live There.” “Renters unwelcome: Unless you are leasing a luxury home, that is. Otherwise, the total lack of apartments in the city means that many San Marino workers can’t afford to live there.” [Scott Garner, “Neighborhood Spotlight: San Marino’s exclusivity was always the plan,” Los Angeles Times, 05/23/18]

Tim Sloan Owns A $5.1 Million Beachfront Condo In Affluent Montecito, A Part Of Santa Barbara, California, Located Next To An “Exclusive” Resort Club With A $300,000 Initiation Fee.

Tim Sloan Owns A $5.1 Million Beachfront Condo In An Affluent “Guarded And Gated […] Enclave” In Santa Barbara, California.

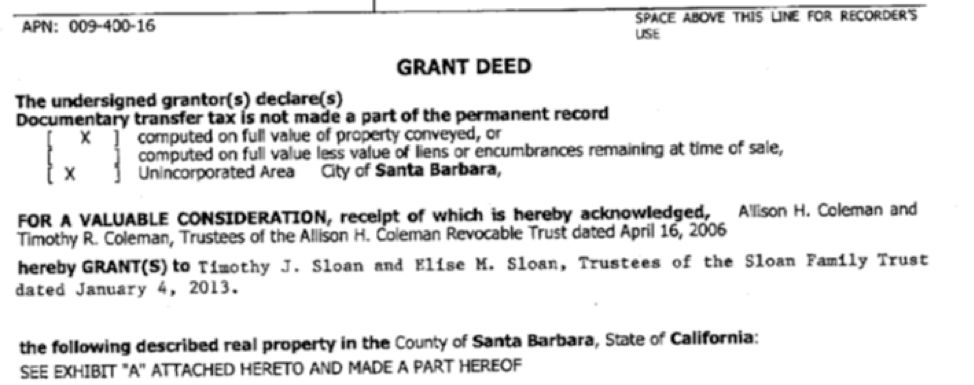

On May 8, 2014, Tim And Elise Sloan Were Granted The Deed To A Property In Santa Barbara, California Identified With Assessor Parcel Number (APN) 009-400-016. [Grant Deed, APN: 009-400-16, Santa Barbara County, 05/16/14]

[Grant Deed, APN: 009-400-16, Santa Barbara County, 05/16/14]

Parcel 009-400-016 Has A 2018 Net Assessed Value Of $5,117,505. The home is 1,694 sq. ft. with two bedrooms and two and a half bathrooms. The home has a net assessed value of $5,117,505. [“Assessor Parcel Information Details,” Assessor, County of Santa Barbara, accessed 03/08/19]

The Property Was Sold For $4.75 Million In May 2014. The property “was listed […] in September 2012 asking $5,250,000. It sold in May 2014 for $4,750,000.” [“New Bonnymede Beachfront Escrow Closing,” Montecito Shores & Bonnymede Blog, 05/16/14]

The Luxury Beachfront Condo In A “Guarded And Gated […] Enclave” With “Spectacular” Ocean Views. “Unsurpassed ocean, island and coastline views are enjoyed from [the property], a sophisticated residence on the sand within Montecito’s guarded and gated beachfront condominium enclave. […] Finished with exquisite Venetian plaster, the living room, dining area and beautifully appointed kitchen, with limestone counters and custom cabinetry, all offer ocean and island views. The spacious master bedroom opens to the dramatic limestone beachfront terrace with truly spectacular sunrise to sunset views, including a unique and romantic view of Santa Barbara’s sparkling city lights at night.” [“New Bonnymede Beachfront Escrow Closing,” Montecito Shores & Bonnymede Blog, 05/16/14]

[“New Bonnymede Beachfront Escrow Closing,” Montecito Shores & Bonnymede Blog, 05/16/14]

Tim Sloan’s Beachfront Condo Is Located In Montecito, “One Of America’s Most Affluent Communities.”

The Property Is Located In Montecito, A Part Of Santa Barbara. “Unsurpassed ocean, island and coastline views are enjoyed from [the property], a sophisticated residence on the sand within Montecito’s guarded and gated beachfront condominium enclave. [“New Bonnymede Beachfront Escrow Closing,” Montecito Shores & Bonnymede Blog, 05/16/14]

- Santa Barbara Tourism Website: “No Other Town Does Luxury Or Exudes An Effortlessly Chic Vibe Like Montecito.” [“Montecito,” Visit Santa Barbara, accessed 03/08/19]

- According To A Paid Feature In The New York Times, Montecito Is “One Of America’s Most Affluent Communities,” Home To “America’s Upper Echelons” Like Oprah Winfrey And Ellen Degeneres. “For nearly a century, America’s upper echelons have found a refuge in this leafy, intimate and private community along the American Riviera. […] coastal Montecito is one of America’s most affluent communities and home to household names like Oprah Winfrey, Ellen Degeneres and Rob Lowe. Yet, luxury in this well-heeled neighborhood is not opulent, ostentatious or extravagant.” [“In Montecito, Bask in California Glamour,” The New York Times, accessed 03/08/19]

Tim Sloan’s Beachfront Condo Sits Next To An “Exclusive” Resort Club With A $300,000 Initiation Fee.

Tim Sloan’s Beachfront Condo Is Located Next To The Coral Casino Beach And Cabana Club Resort. [Google Maps, accessed 03/08/19]

[Google Maps, accessed 03/08/19]

The Four Seasons’ Coral Casino Beach And Cabana Club “Has Been The Backdrop Of Countless Society Events Attended By Hollywood Elite And Extravagant Overwater Fashion Shows.” “Built in 1937, the Coral Casino is an exclusive private membership social club that has been the backdrop of countless society events attended by Hollywood elite and extravagant overwater fashion shows.” [“Coral Casino Beach and Cabana Club,” Four Seasons, accessed 03/08/19]

- The Coral Casino Beach And Cabana Club Is “One Of California’s Most Exclusive Clubs” And Has A $300,000 Initiation Fee. “The Coral Casino Beach and Cabana Club, which has drawn Los Angeles elites since it opened in 1937, isn’t easy to get into. You can’t just buy your way in; you have to be referred by a member in good standing. The initiation fee is $300,000, and that’s before annual dues.” [Ann Abel, “Getting Into One Of California’s Most Exclusive Clubs For The Price Of A Hotel Room: Four Seasons Santa Barbara,” Forbes, 04/30/13]

In 2016, Wells Fargo Was Exposed For Opening Millions Of Fake Accounts To Meet Problematic Sales Goals. The Bank Has Yet To Reform Its Predatory And Aggressive Sales Culture.

Just Over Three Years Ago, Wells Fargo Was Fined More Than $185 Million By Federal Regulators After The Bank Fraudulently Opened More Than 2 Million Fake Customer Accounts.

Wells Fargo Was Fined A Total Of $185 Million By The CFPB, OCC, And Los Angeles Governments For Opening More Than 2 Million Fake Customer Accounts.

In September 2016, The CFPB Found That Wells Fargo Illegally Opened More Than Two Million Unauthorized Accounts. “[…] [T]he Consumer Financial Protection Bureau (CFPB) fined Wells Fargo Bank, N.A. $100 million for the widespread illegal practice of secretly opening unauthorized deposit and credit card accounts.” [Press Release, Consumer Financial Protection Bureau, 09/08/16]

- Wells Fargo Was Ordered To Pay “Full Restitution To All Victims,” Plus A $100 Million Fine To The CFPB, $35 Million To The U.S. Comptroller Of The Currency, And $50 Million To Los Angeles City And County. “Wells Fargo will pay full restitution to all victims and a $100 million fine to the CFPB’s Civil Penalty Fund. The bank will also pay an additional $35 million penalty to the Office of the Comptroller of the Currency, and another $50 million to the City and County of Los Angeles.” [Press Release, Consumer Financial Protection Bureau, 09/08/16]

Wells Fargo Employees, Incentivized To Open The Accounts By The Bank’s Sales Targets, Inappropriately Moved Money From Customers’ Authorized Accounts And Often Incurred Fees That Otherwise Would Not Have Been Charged. “Spurred by sales targets and compensation incentives, employees boosted sales figures by covertly opening accounts and funding them by transferring funds from consumers’ authorized accounts without their knowledge or consent, often racking up fees or other charges.” [Press Release, Consumer Financial Protection Bureau, 09/08/16]

Wells Fargo Later Admitted That It Had Created As Many As 3.5 Million Fake Accounts, Not 2.1 Million As Previously Estimated, Over A Span Of Time Twice As Long As Originally Estimated.

In August 2017, Wells Fargo Revealed That It Has Created Many More Fake Accounts Than It Had Originally Disclosed, Raising The Total Number From 2.1 Million To 3.5 Million. “[…] [T]he bank acknowledged it had created more bogus customer accounts than previously estimated. An outside review discovered that 1.4 million more potentially unauthorized accounts were opened between January 2009 and September 2016. That brings the total to 3.5 million potentially fake accounts — two-thirds more than the 2.1 million the bank had previously acknowledged.” [Uli Berliner, “Wells Fargo Admits To Nearly Twice As Many Possible Fake Accounts — 3.5 Million,” NPR, 08/31/17]

- The New Estimate Covered A Time Period Two Times As Long As The Original Revelation. “The latest review looked at a window of time twice as long — from January 2009 through September 2016 — and found the additional accounts.” [Uli Berliner, “Wells Fargo Admits To Nearly Twice As Many Possible Fake Accounts — 3.5 Million,” NPR, 08/31/17]

- Approximately 190,000 Of Fake Accounts “Incurred Charges And Fees,” Prompting Wells Fargo To Promise $2.8 Million More In Refunds To Harmed Consumers. “[…] [A]bout 190,000 of the 3.5 million potentially unauthorized accounts incurred charges and fees. The bank says it will provide an additional $2.8 million in customer refunds and credits.” [Uli Berliner, “Wells Fargo Admits To Nearly Twice As Many Possible Fake Accounts — 3.5 Million,” NPR, 08/31/17]

Wells Fargo Gave One Consumer An Unauthorized Credit Card That Collected $1,000 In Fees, Sank His Credit Score By 125 Points, And Made It “Nearly Impossible For Him To Qualify For A Loan” When He Tried To Buy A House Years Later.

One Wells Fargo Customer Said The Bank Sent Him A Credit Card He Didn’t Ask For — The Unauthorized Card Eventually Accumulated Almost $1,000 In Fees. “Aaron Brodie, who works for the police department in Fort Worth, said he opened a Wells Fargo checking account in 2012 and was sent a credit card he didn’t want. Brodie said he was told by the bank he could ignore the card but learned a year later it had accumulated nearly $1,000 in various late and maintenance fees. He closed the checking account and refused to pay what he considered the bogus credit card bill. ‘They told me they couldn’t help me,’ he said.” [Renae Merle, “Wells Fargo’s scandal damaged their credit scores. What does the bank owe them?,” The Washington Post, 08/18/17]

- When The Customer Tried To Apply For A Home Loan Years Later, He Learned That The Unauthorized Credit Card Had Dropped His Credit Score By 125 Points, “Making It Nearly Impossible For Him To Qualify For A Loan.” “When he tried to buy a home several years later, Brodie said, he learned the incident had lowered his credit score by 125 points, making it nearly impossible for him to qualify for a loan.” [Renae Merle, “Wells Fargo’s scandal damaged their credit scores. What does the bank owe them?,” The Washington Post, 08/18/17]

One Wells Fargo Customer Said The Bank Opened Seven Unauthorized Accounts That Damaged His Credit Score.

A Wells Fargo Customer Said The Bank Opened Seven Accounts Without His Authorization, And His Credit Score Suffered From Unpaid Fees That Had Been Referred To A Debt Collector. “One Wells customer in Northern California, Shahriar Jabbari, had seven additional accounts that he did not consent to, according to a lawsuit he filed against the bank last year in federal court. When Mr. Jabbari called the bank asking what he should do with three new debit cards he did not authorize, a bank employee told him to dispose of them, according to the lawsuit. Mr. Jabbari said in the lawsuit that his credit score had suffered because unpaid fees on the unauthorized accounts had been sent to a debt collector.” [Michael Corkery, “Wells Fargo Fined $185 Million for Fraudulently Opening Accounts,” The New York Times, 09/08/16]

In The Time Since The Scandal Broke, Wells Fargo Has Seen Billions Of Dollars In Penalties, Unprecedented Federal Reserve Restrictions, And Federal Scrutiny Over “Nearly Every One Of [Its] Business Lines.”

In Just Over Three Years Since Then, Wells Fargo’s Practices Have Been Subject To More Than $4 Billion In Fines And Settlements, Unprecedented Federal Reserve Oversight, And Investigation By A Wide Range Of Federal Regulators.

In The Time Since Wells Fargo Revealed The Practices That Led To The Fake Account Scandal, The Bank Has Fired Its Previous CEO, Paid Billions Of Dollars In Fines And Settlements, And Has Been The Subject Of Unprecedented Federal Reserve Restrictions. “The scandal has been costly for Wells Fargo. Its chief executive was pushed out. The bank has paid more than $1.5 billion in penalties to federal and state authorities, and $620 million to resolve lawsuits from customers and shareholders. Most painful, the Federal Reserve punished the bank in February 2018 by prohibiting it from expanding until it cleaned up its culture and internal checks and balances — a restriction that remains in force.” [Emily Flitter and Stacy Cowley, “Wells Fargo Says Its Culture Has Changed. Some Employees Disagree.,” The New York Times, 03/09/19]

- In The Years Since The Fake Account Scandal Erupted, “Nearly Every One Of The Bank’s Business Lines Is Under Investigation by A Government Agency.” “[…] [N]early every one of the bank’s business lines is under investigation by a government agency, including the Justice Department and the Securities and Exchange Commission. Among the most serious, officials at the Office of the Comptroller of the Currency, one of the bank’s chief regulators, are debating a rare step: whether to force out additional top executives or directors, according to a person familiar with the matter. The OCC has spent so much time dealing with Wells Fargo that it is even considering charging it a special fee, according to people familiar with the matter.” [Emily Glazer, “Washington Wants to Know Why Timothy Sloan Hasn’t Fixed Wells Fargo,” The Wall Street Journal, 03/11/19]

Last Year, The Federal Reserve Took The Unprecedented Step Of Restricting Wells Fargo’s Growth And Forcing It To Replace One-Quarter Of Its Board For “Years Of Misconduct” And Has Continued To Restrict Its Size Due To Wells Fargo’s Failure To Fully Reform Its Consumer Abuses.

In February 2018, The Federal Reserve Punished Wells Fargo’s Consumer Abuses By Limiting Its Size – The Fed Had Not “Previously Imposed Strict Limits On A Major Bank’s Growth.”

In February 2018, The Federal Reserve Restricted Wells Fargo’s Growth Until It Improved Its Practices And Forced The Bank To Replace One-Quarter Of Its Board. “The Federal Reserve on Friday imposed unusually harsh penalties on Wells Fargo, punishing it for years of misconduct and barring it from future growth until the bank fixes its problems. The central bank blasted Wells Fargo’s board for failing to oversee the bank, and it announced that the company would replace four members of its 16-person board by the end of the year. […] ‘Until the firm makes sufficient improvements, it will be restricted from growing any larger than its total asset size as of the end of 2017,’ the Fed said.” [Emily Flitter, Binyamin Appelbaum, and Stacy Cowley, “Federal Reserve Shackles Wells Fargo After Fraud Scandal,” The New York Times, 02/02/18]

- The Federal Reserve Barred Wells Fargo From Growing Beyond Its $2 Trillion Worth. “The bank had nearly $2 trillion in assets at the end of 2017. Going forward, the Fed will not let Wells Fargo’s average balance sheet expand beyond that size, according to a senior Fed official. Because large banks’ assets tend to expand as the economy grows, the Fed believes that this limitation will be a significant constraint on the bank’s ability to grow.” [Emily Flitter, Binyamin Appelbaum, and Stacy Cowley, “Federal Reserve Shackles Wells Fargo After Fraud Scandal,” The New York Times, 02/02/18]

- The Federal Reserve’s Requirements Were “Uncommon,” And It Had Not “Previously Imposed Strict Limits On A Major Bank’s Growth.” “The central bank’s penalties are uncommon. The Fed’s regulators have routinely penalized banks for misconduct, but they have not previously imposed strict limits on a major bank’s growth.” [Emily Flitter, Binyamin Appelbaum, and Stacy Cowley, “Federal Reserve Shackles Wells Fargo After Fraud Scandal,” The New York Times, 02/02/18]

In December 2018, The Federal Reserve Continued To Restrict Wells Fargo’s Growth Because It Failed To Submit A Plan To Adequately Prevent Future Consumer Abuses.

In December 2018, Federal Reserve Chairman Jerome Powell Said The Fed Would Continue To Restrict Wells Fargo’s Growth To “Prevent Any Further Abuse Of Its Customers.” “Wells Fargo & Co […] must keep a lid on its growth until the bank has hardened its risk management policies to prevent any further abuse of its customers, said Jerome Powell, chairman of the Federal Reserve.” [Patrick Rucker and Imani Moise, “Wells Fargo won’t be allowed to grow unless problems fixed: Fed’s Powell,” Reuters, 12/10/18]

- Wells Fargo Was Still “Months Behind Schedule On Submitting An Acceptable Reform Plan.” “Wells Fargo has so far failed to satisfy the Fed and the bank is months behind schedule on submitting an acceptable reform plan, Reuters reported […].” [Patrick Rucker and Imani Moise, “Wells Fargo won’t be allowed to grow unless problems fixed: Fed’s Powell,” Reuters, 12/10/18]

The Fed Continued To Restrict Wells Fargo’s Size “Until It Put New Checks On Senior Managers And Gave The Board New Powers To Sniff Out Abuses.” “In February, the Fed ordered Wells Fargo to freeze its balance sheet, keeping its assets below $1.95 trillion, until it put new checks on senior managers and gave the board new powers to sniff out abuses.” [Patrick Rucker and Imani Moise, “Wells Fargo won’t be allowed to grow unless problems fixed: Fed’s Powell,” Reuters, 12/10/18]

Sen. Elizabeth Warren (D-MA) Has Demanded That The Fed Not Lift Its Restrictions Until Wells Fargo CEO Tim Sloan Is Fired.

Senator Elizabeth Warren (D-MA) Requested That The Fed Not Lift Its Restrictions On Wells Fargo Until CEO Tim Sloan, Was Removed Because She Asserted He Was “‘Deeply Implicated’” In The Bank’s Misconduct. “Warren, a Massachusetts Democrat, has been a vocal critic of Wells Fargo and its Chief Executive Tim Sloan. In October, Warren wrote a letter asking the regulator not to remove the asset cap until Sloan is removed, charging that Sloan was ‘deeply implicated’ in the misdeeds of the past. Wells Fargo has called Sloan’s 30-year tenure at the bank an asset and said he has the full support of its board.” [Patrick Rucker and Imani Moise, “Wells Fargo won’t be allowed to grow unless problems fixed: Fed’s Powell,” Reuters, 12/10/18]

Last Year, Wells Fargo Agreed To Pay $480 Million To Investors Who Claimed The Bank Engaged In Securities Fraud By Artificially Boosting Its Stock Price By “Burdening Customers” With Unauthorized Products.

In May 2018, Wells Fargo Settled For $480 Million With Investors Who Claimed The Bank Illegitimately Inflated Its Stock Prices With Its Fraudulent Practices, Boosting Profits While “‘Burdening Customers With Financial Products They Did Not Authorize, Need And/Or Even Know About.’”

In May 2018, Wells Fargo Agreed To Settle A $480 Million Class Action Lawsuit That Stemmed From Its Fake Accounts Scandal. “Wells Fargo & Co. […] agreed to pay $480 million to settle a class-action lawsuit accusing the banking giant of securities fraud related to the fake-accounts scandal that has rocked the company since 2016. The San Francisco-based bank denied the allegations but said it had ‘entered into the agreement in principle to avoid the cost and disruption of further litigation.’” [James F. Peltz, “Wells Fargo agrees to pay $480 million to settle securities-fraud lawsuit over fake accounts,” Los Angeles Times, 05/04/18]

Investors Behind The Lawsuit Argued That Wells Fargo Did Not Disclose Its Knowledge That “‘The Company’s Cross-Selling Strategy Was Not Focused On Or Designed To Benefit Customers’” And That It Sought To “‘Increase Sources Of Profitability While Simultaneously Burdening Customers With Financial Products They Did Not Authorize, Need And/Or Even Know About.’” “In the class action suit filed with the U.S. District Court in San Francisco, the investors claimed that Wells Fargo ‘knew but deliberately failed to disclose known material true facts’ about its actions, including ‘that the company’s cross-selling strategy was not focused on or designed to benefit customers.’ Rather, the effort was ‘designed to fulfill sales quotes or otherwise advance the interests of Wells Fargo or its employees and increase sources of profitability while simultaneously burdening customers with financial products they did not authorize, need and/or even know about,’ the suit claimed. That scenario resulted in Wells Fargo’s stock trading at “artificially inflated prices,” the suit claimed.” [James F. Peltz, “Wells Fargo agrees to pay $480 million to settle securities-fraud lawsuit over fake accounts,” Los Angeles Times, 05/04/18]

At The End Of Last Year, Wells Fargo Settled For $575 Million With Every State In The Union (Plus D.C.) For Harming Consumers With Its Fake Accounts, Improper Charges To Mortgage And Auto Loan Customers, And Other Abuses.

In December 2018, Wells Fargo Settled For $575 Million With Every State In The Union And The District Of Columbia For Abuses Related To Its Fake Account Scandal And Improper Charges To Its Auto-Loan And Mortgage Customers.

In December Of 2018, Wells Fargo Agreed To A $575 Million Settlement With All The States And D.C. For Its Fake-Account Scandal And “Improper Auto-Loan And Mortgage Charges.” “Wells Fargo & Co. has agreed to pay $575 million to all 50 states and the District of Columbia to settle claims that a fake-account scandal in its retail bank and improper auto-loan and mortgage charges harmed customers.” [Emily Glazer, “Wells Fargo to Pay States About $575 Million to Settle Customer Harm Claims,” The Wall Street Journal, 12/28/18]

The Settlement Was The Product Of “Long-Running Investigations Across The Country” About The Bank’s Harmful Practices Going As Far Back As 2002. “The settlement, which requires court approval in certain states, follows a number of long-running investigations across the country focused on Wells Fargo’s sales practices and problems in its consumer-lending business, some of which date to 2002.” [Emily Glazer, “Wells Fargo to Pay States About $575 Million to Settle Customer Harm Claims,” The Wall Street Journal, 12/28/18]

- The December Settlement Was Just “The Latest In A String Of Settlements” That Occurred In The Wake Of The Fake Account Scandal. “It is the latest in a string of settlements for the bank following revelations more than two years ago that Wells Fargo branch employees opened perhaps millions of fake accounts without customer knowledge.” [Emily Glazer, “Wells Fargo to Pay States About $575 Million to Settle Customer Harm Claims,” The Wall Street Journal, 12/28/18]

Since The Fake Account Scandal, “Problems Have Emerged In Nearly Every Major Business In The Bank,” Including Its Auto-Loan Insurance And Mortgage Operations. “Since then, problems have emerged in nearly every major business in the bank. The bank also has acknowledged it sold unnecessary insurance coverage to auto-loan customers and charged improper fees to mortgage customers.” [Emily Glazer, “Wells Fargo to Pay States About $575 Million to Settle Customer Harm Claims,” The Wall Street Journal, 12/28/18]

Just This Month, It Was Reported That Wells Fargo Executives Agreed To A Record-Smashing $240 Million Settlement With Investors Who Argued The Bank’s Top Brass Knew About The Fake Accounts And Didn’t Stop Them.

Just This Month, It Was Reported That Wells Fargo Executives Agreed To A Record $240 Million Settlement With Investors Who Alleged They “Breached Their Fiduciary Duties” By Letting Employees Continue Creating Bogus Accounts; The Money Was Returned To Wells Fargo.

In March 2019, It Was Reported That Twenty Wells Fargo Executives Reached A Record $240 Million Settlement With Shareholders Who Claimed That The Bank’s Executives “Breached Their Fiduciary Duties By Knowing About Or Consciously Disregarding The Bogus Accounts” That Had Been The Subject Of Major Controversy Since September 2016. “Wells Fargo & Co officials have reached a record $240 million settlement with U.S. shareholders over the creation by bank employees of millions of unauthorized customer accounts. The settlement was filed late Thursday with the federal court in San Francisco, and requires a judge’s approval. It resolves claims that the officials breached their fiduciary duties by knowing about or consciously disregarding the bogus accounts, and failing to stop their creation. Insurers for 20 current and former Wells Fargo executives and directors, including Chief Executive Tim Sloan and his predecessor John Stumpf, will pay the $240 million to the bank. The officials denied wrongdoing.” [Jonathan Stempel and Dena Aubin, “Wells Fargo officials make record $240 million settlement over bogus accounts,” Reuters, 03/01/19]

- The Settlement Was Larger Than News Corp’s Then-Record $139 Million Settlement Over Its Phone Hacking Scandal. Shareholders’ “lawyers called the accord the largest insurer-funded cash settlement in a U.S. shareholder derivative lawsuit, surpassing News Corp’s $139 million accord in 2013 over its handling of a phone hacking scandal in Britain.” [Jonathan Stempel and Dena Aubin, “Wells Fargo officials make record $240 million settlement over bogus accounts,” Reuters, 03/01/19]

- Settlement Money Went Back To Wells Fargo, Rather Than Directly To The Shareholders Individually. “Shareholders bring derivative lawsuits on behalf of companies, typically when the defendants are corporate officers or board members, with proceeds going to the companies.” [Jonathan Stempel and Dena Aubin, “Wells Fargo officials make record $240 million settlement over bogus accounts,” Reuters, 03/01/19]

Years Before The Fake Account Scandal Broke, CEO Tim Sloan Was In The Thick Of Wells Fargo’s Aggressive And Predatory Sales Culture: “Employees Take The Blame, And Wells Fargo Reaps The Profits.”

Tim Sloan Had A “Front-Row Seat” To Wells Fargo’s “Troubling Sales Practices” For Years Before The Fake Account Scandal Erupted.

Tim Sloan Admitted He Was Aware Of Wells Fargo’s “Troubling Sales Practices” As Early As 2013.

Tim Sloan Admitted He Was Aware Of Wells Fargo’s “Troubling Sales Practices” As Early As 2013. “He has said he was aware of the troubling sales practices as early as late 2013 […]” [James Rufus Koren, “CEO Tim Sloan has had two years to fix Wells Fargo. Is he running out of time?,” The Los Angeles Times, 11/25/18]

Tim Sloan Had A “Front-Row Seat To Top Executives’ Deliberations Over Management Issues” For Years Before The Fake Account Scandal…

For Years Before The Scandal, Tim Sloan Had A “Front-Row Seat To Top Executives’ Deliberations Over Management Issues, Strategy And Handling Risks.” “He also has sat for years on the company’s operating committee, giving him a front-row seat to top executives’ deliberations over management issues, strategy and handling risks.” [Dakin Campbell, “The Man Who May Inherit the Mess at Wells Fargo,” Bloomberg, 09/23/16]

…And Federal Investigators Argued That Those Executives Knew About Wells Fargo’s Problems For A Decade.

“Federal Investigators Alleged Executives Knew About The Problem For A Decade.” [Laura J. Keller and Shahien Nasiripour, “Does Wells Fargo Have a Plan?,” Bloomberg, 03/01/18]

Tim Sloan Directly Supervised The Head Of The Unit Responsible For Opening Unauthorized Accounts.

The Head Of The Unit Responsible For Opening Unauthorized Accounts Reported Directly To Timothy Sloan Once He Became Wells Fargo’s COO.

Carrie Tolstedt, The Executive In Charge Of The Unit Responsible For The Fraudulent Account Activity, Reported Directly To Sloan In The Time Before The Scandal Became Public. “Sloan said Tuesday on CNBC that Carrie Tolstedt, who led the bank’s community banking unit where the misconduct occurred, reported directly to him when he became the chief operating officer late last year.” [Jonnelle Marte, “What we know about Tim Sloan, the new CEO of Wells Fargo,” The Washington Post, 10/13/16]

- Sloan Became Tolstedt’s Boss In November 2015, When He Became Wells Fargo’s Chief Operating Officer. “In November 2015 Sloan became Tolstedt’s boss, when his new role as COO and president gave him oversight of her community banking division.” [Dakin Campbell, “The Man Who May Inherit the Mess at Wells Fargo,” Bloomberg, 09/23/16]

As Early As 2014, Tim Sloan Bragged About The Profit-Making Potential Of Wells Fargo’s Aggressive Cross-Selling Practices, Which Helped Make It The “World’s Most Valuable Bank” Following The Financial Crisis.

Tim Sloan Bragged About Wells Fargo’s Cross-Selling Practices, Which Helped It Become One Of Only Six Public American Companies To Make More Than $10 Billion In Profits Since 2010.

In 2014, Tim Sloan “Touted The Bank’s Ability To Sell More To Every Customer.” “As a senior executive, Sloan, too, touted the bank’s ability to sell more to every customer. ‘The more that we cross-sell, the more revenue grows,’ he said in May 2014.” [Laura J. Keller and Shahien Nasiripour, “Does Wells Fargo Have a Plan?,” Bloomberg, 03/01/18]

Wells Fargo’s Cross-Selling Strategy—”Getting Customers To Sign On To Multiple Products, From Checking To Mortgages To Credit Cards”—Helped Make It “One Of Only Six Publicly Traded U.S. Companies To Have Generated More Than $10 Billion In Annual Profit Since 2010,” Alongside Apple. Wells Fargo was “one of only six publicly traded U.S. companies to have generated more than $10 billion in annual profit since 2010, data compiled by Bloomberg show, putting it in the same league as Apple Inc. Wells Fargo built that long-term record on its legendary ability to sell. Calling its branches stores, executives focused on cross-selling—getting customers to sign on to multiple products, from checking to mortgages to credit cards.” [Laura J. Keller and Shahien Nasiripour, “Does Wells Fargo Have a Plan?,” Bloomberg, 03/01/18]

Wall Street “Loved” The Cross-Selling Strategy, And Wells Fargo Eventually Became The “World’s Most Valuable Bank” Following The Financial Crisis. “Calling its branches stores, executives focused on cross-selling—getting customers to sign on to multiple products, from checking to mortgages to credit cards. […] Wall Street loved it, and for a few years after the financial crisis, Wells Fargo was the world’s most valuable bank. (Now it’s No. 4. [as of March 2018])” [Laura J. Keller and Shahien Nasiripour, “Does Wells Fargo Have a Plan?,” Bloomberg, 03/01/18]

Three Months Before The Fake Account Scandal Erupted, Tim Sloan Did Not Believe That Wells Fargo’s Sales Tactics Were Problematic And Even Claimed They Were Executed “Correctly, And Appropriately.”

Tim Sloan Was Asked If Their Sales Cross-Selling Strategy Had Been Pushed To The Limit And He Said “No.”

Tim Sloan Flatly Said “No” When Asked If He Believed That Wells Fargo’s Sales Tactics Had Been Pushed To The Limit. Sloan was asked, “On the topic of cross-selling […] Is there any sense that the bank has pushed that strategy to the limit?” Sloan replied, “No. Because when you think of our vision, it’s to satisfy our customers’ financial needs, and to help them succeed financially. We know a lot about our customers, and so doesn’t it make sense that we would use our data and match it with our product set to try to broaden our relationship with our customer?” [Kristin Broughton and Robert Barba, “Picking the Brain of Wells Fargo’s (Likely) Next CEO,” American Banker, 06/16/16]

Tim Sloan Claimed There Was No Problem With Wells Fargo’s “Fundamental Strategy” Of Cross-Selling And That The Company Made Sure To “Do It Correctly, And Appropriately.”

Tim Sloan Claimed There Was No Problem With Wells Fargo’s “Fundamental Strategy” Of Cross-Selling And That The Company Made Sure To “Do It Correctly, And Appropriately.” “How we do it, how we talk about it, making sure that we do it correctly, and appropriately – and making sure we follow regulations – that will continue to evolve. But the fundamental strategy that we have is not going to change.” [Kristin Broughton and Robert Barba, “Picking the Brain of Wells Fargo’s (Likely) Next CEO,” American Banker, 06/16/16]

Even Before The Fake Account Scandal Broke, Wells Fargo Had Built A Reputation For Ruthless Management And High Pressure Sales Targets.

Front-Line Wells Fargo Workers Have Exposed A Climate Of Pressure And “Incredible Demands” From Management To Meet Sales Quotas.

Wells Fargo Employees Have Said That “Incredible Demands From Managers To Meet Sales Quotas” Would Strain Legal And Ethical Boundaries. “Former employees tell CNNMoney that they felt incredible demands from managers to meet sales quotas. The same managers turned a blind eye when ethical and even legal lines were crossed.” [Matt Egan, “Workers tell Wells Fargo horror stories,” CNN, 09/09/16]

One Wells Fargo Employee Claimed That Managers Would Yell At Her, Forcing Her To “‘Open Up Dual Checking Accounts For People Who Couldn’t Even Manage Their Original Checking Account.’” “‘I had managers in my face yelling at me,’ Sabrina Bertrand, who worked as a licensed personal banker for Wells Fargo in Houston in 2013, told CNNMoney. ‘They wanted you to open up dual checking accounts for people that couldn’t even manage their original checking account.’” [Matt Egan, “Workers tell Wells Fargo horror stories,” CNN, 09/09/16]

Former Wells Fargo Employees Said Pressure To Increase Sales Was So Intense That They Became Addicted To Hand Sanitizer, Developed Shingles, Would Regularly Hide In The Bathroom To Cry, And Began To Fear Strokes And Heart Attacks.

Wells Fargo Employees Were Pressured Into Selling Eight Products To Each Of Their Customers And, When They Couldn’t Meet The Quotas, “‘Threats From Upper Management’” Would Force Them To Meet Their Numbers By Opening Accounts For Friends And Family.

Wells Fargo’s “Gr-Eight Initiative’” Incentivized The Bank’s Employees In “Selling At Least Eight Financial Products To Each Customer.” “With more commercial banking market share than any other U.S. bank, Wells Fargo sought to expand profitability by adopting a »cross-selling« strategy called the »Gr-eight Initiative« (D’Acosta, 2017). The initiative set an internal goal for employees of selling at least eight financial products to each customer and connected incentive compensation to this goal.” [Stephen Lerner et al., “Tipping the Balance,” Friedrich Ebert Stiftung, September 2018]

One Worker Said Of The Fake Accounts Scandal, It “‘Was Not Done By Employees Trying To Hit Their Sales Numbers, It Was More Of Threats From Upper Management,’” “One former Wells Fargo employee, who requested his name not be used so he doesn’t hurt his career in banking, said he experienced this firsthand. He said managers told him to open unauthorized accounts and, when customers called, to apologize and say it was a mistake. ‘This was not done by employees trying to hit their sales numbers, it was more of threats from upper management,’ he said, adding that workers feared they would lose their job.” [Matt Egan, “Workers tell Wells Fargo horror stories,” CNN, 09/09/16]

- One Worker Said “’There Would Be Days Where We Would Open Five Checking Accounts For Friends And Family Just To Go Home Early.’” “[…] [H]e did open accounts for friends and family — with their permission — in order to meet the incredible demands from managers. ‘There would be days where we would open five checking accounts for friends and family just to go home early,’ he said.” [Matt Egan, “Workers tell Wells Fargo horror stories,” CNN, 09/09/16]

“I Was Completely Addicted To Hand Sanitizer And Drinking At Least A Bottle A Day During My Workday.”

One Wells Fargo Employee Said, Due To The Bank’s Extreme Sales Targets, “I Was Completely Addicted To Hand Sanitizer And Drinking At Least A Bottle A Day During My Workday.” “I started to have extreme physical stress-related symptoms as well as random panic attacks. At some point during that summer, the stress was so intense that I could no longer handle the pressure. On the banker’s desk, in the bathroom, behind the teller line and in the vault, the store kept bottles of hand sanitizer. One morning, before meeting with a customer, in which I knew I was going to have to sell unneeded services, I had a severe panic attack. I went to the bathroom and took a drink of some hand sanitizer. This immediately reduced my anxiety. From that point, I began drinking the hand sanitizer all over the bank. In late November 2012, I was completely addicted to hand sanitizer and drinking at least a bottle a day during my workday.” [Stacy Cowley, “Voices From Wells Fargo: ‘I Thought I Was Having a Heart Attack,’” The New York Times, 10/20/16]

“I Would Hide In The Men’s Bathroom Crying,” And “I Thought I Was Going To Have A Heart Attack Or Stroke.”

One Wells Fargo Worker Said, Due To The Bank’s Extreme Sales Targets, “There Were Numerous Days Where I Would Hide In The Men’s Bathroom Crying,” And Said He Quit Because, “I Thought I Was Going To Have A Heart Attack Or Stroke If I Stayed Any Longer.” “I believe my daily product sales goal was six a day. It didn’t matter if you had 20 products one day, you still had to meet your goal every other day. […] There were numerous days where I would hide in the men’s bathroom crying. It got so bad that one day I left work to go to the emergency room because I thought I was having a heart attack. It turns out it was an anxiety attack. I thought I was going to have a heart attack or stroke if I stayed any longer.” [Stacy Cowley, “Voices From Wells Fargo: ‘I Thought I Was Having a Heart Attack,’” The New York Times, 10/20/16]

“I Developed Shingles” From Having To Explain Every Morning ““Why I Didn’t Force [Customers] Into Opening That Third, Fourth, Fifth Checking Account.”

One Wells Fargo Worker Said She Developed Shingles Because Every Morning She Would Have To Explain To Her Manager “Why I Didn’t Force [Customers From The Previous Day] Into Opening That Third, Fourth, Fifth Checking Account […] For Christmas, Their Son’s Birthday, School, A Pet And So On.” “Every morning I had to sit with my boss and go over the previous day and every single customer’s relationship. I had to tell them why I didn’t force them into opening that third, fourth, fifth checking account that they could have used for Christmas, their son’s birthday, school, a pet and so on. I had to explain why I did not feel comfortable with pushing people into paying for something they did not need. I was so stressed out, I developed shingles.” [Stacy Cowley, “Voices From Wells Fargo: ‘I Thought I Was Having a Heart Attack,’” The New York Times, 10/20/16]

“I Felt Like A Cheat.”

One Wells Fargo Worker Said The Bank’s Sales Culture Made Her Feel “Like A Cheat,” And Said Her District Manager And Direct Supervisor Retaliated Against Her Once She Made A Report To The Corporate Ethics Hotline. “We would have conference calls with regional presidents and managers coaching us on how to word our selling points so the customer can’t say no. I felt like a cheat. I started losing sleep and got nauseous every Sunday night over the start of the next workweek. This year, I reported a customer incident to the corporate office and the ethics line. Soon after, my district manager showed up. Not his usual friendly self, either — he just grabbed my manager and sat in the back office with the door closed. I started to feel sick. After an hour or so, he walked out. My manager then called me into the back office to give me a performance improvement plan. Retaliation at its finest.” [Stacy Cowley, “Voices From Wells Fargo: ‘I Thought I Was Having a Heart Attack,’” The New York Times, 10/20/16]

“The Goals […] Were So Insane That There Was No Way To Reach Them Without Lying Or Committing Fraud.”

One Wells Fargo Worker, Who Was Once Awarded “For Being In The Top 2 Percent Of Managers In The Country For Sales,” Said The Bank’s Sales Targets “Were So Insane That There Was No Way To Reach Them Without Lying Or Committing Fraud.” “I got terminated for not achieving my sales goals one year after receiving an annual award for being in the top 2 percent of managers in the country for sales. I moved to a new branch, and the goals in that branch were so insane that there was no way to reach them without lying or committing fraud.” [Stacy Cowley, “Voices From Wells Fargo: ‘I Thought I Was Having a Heart Attack,’” The New York Times, 10/20/16]

- She Said Pressure From Her Supervisors Consisted Of “Nonstop Badgering,” “Berating,” And “Verbal And Mental Abuse.” “They would grill us every day; it was nonstop badgering and berating. It was verbal and mental abuse. I was like, ‘I just divorced a guy because he was like this to me, and now I’m working for a company that does it?’” [Stacy Cowley, “Voices From Wells Fargo: ‘I Thought I Was Having a Heart Attack,’” The New York Times, 10/20/16]

20,000 Wells Fargo Workers Petitioned Against The Bank’s “Aggressive” Sales Culture Before The Scandal Broke, And Los Angeles Asserted In A Lawsuit Against The Bank, “‘Employees Take The Blame, And Wells Fargo Reaps The Profits.’”

Before Wells Fargo’s Fake Accounts Scandal Broke, 20,000 Employees Petitioned To End The Bank’s “Aggressive Sales Goals.”

Before The Fake Accounts Scandal Broke Out, 20,000 Wells Fargo Employees Petitioned The Bank To End Its “Aggressive Sales Goals And Performance Pay Systems.” “More than a year before the scandal broke; more than 20,000 Wells Fargo workers signed a petition calling for an end to the aggressive sales goals and performance pay systems. Workers raised the same demands in 2014 and 2015 at Wells Fargo’s annual shareholder meetings. Without any movement from the company in response, workers eventually took direct action, occupying the lobbies of Wells Fargo buildings in Los Angeles and Minneapolis. Workers also came to Washington, D.C., to brief members of Congress, the CFPB, and the Office of Comptroller and Currency (OCC), which led to meaningful enforcement action.” [Stephen Lerner et al., “Tipping the Balance,” Friedrich Ebert Stiftung, September 2018]

Los Angeles Sued Wells Fargo In 2015, Arguing, “‘Employees Take The Blame, And Wells Fargo Reaps The Profits.’”

Los Angeles’ 2015 Lawsuit Against Wells Fargo Showed How The Bank’s Managers Would Discuss “Daily Sales For Each Branch And Employee ‘Four Times A Day.’” “The pressure cooker environment is also described in a lawsuit filed by Los Angeles against Wells Fargo in May 2015. The lawsuit says that Wells Fargo’s district managers discussed daily sales for each branch and employee ‘four times a day, at 11 am, 1 pm, 3 pm and 5 pm.’ It all stems from Wells Fargo’s internal goal of selling at least eight financial products per customer. It’s what Wells Fargo calls the ‘Gr-eight initiative.’ Currently, Wells Fargo boasts an average of about six financial products per customer.’” [Matt Egan, “Workers tell Wells Fargo horror stories,” CNN, 09/09/16]

The Los Angeles Lawsuit Said, “’Wells Fargo Has Engineered A Virtual Fee-Generating Machine, Through Which Its Customers Are Harmed, Its Employees Take The Blame, And Wells Fargo Reaps The Profits.’” “Wells Fargo has ‘known about and encouraged these practices for years,’ the California lawsuit said. ‘Wells Fargo has engineered a virtual fee-generating machine, through which its customers are harmed, its employees take the blame, and Wells Fargo reaps the profits.’” [Matt Egan, “Workers tell Wells Fargo horror stories,” CNN, 09/09/16]

After The Fake Account Scandal Broke, Wells Fargo’s Board “Sharply Criticized” The Bank’s Management For Its “Unattainable” Sales Targets And Failure To See How They Incentivized The Bank’s Consumer Abuses.

In 2017, Wells Fargo’s Board Of Directors “Sharply Criticized The Bank’s Leadership” In A Report Exposing How The Bank’s Upper Management Created “Unattainable” Expectations And Then Failed To See The “‘Systemic’” Connections Between The Bank’s High-Pressure Sales Culture And Its Abuses.

Wells Fargo’s Board Of Directors Issued A Report In Which It “Sharply Criticized The Bank’s Leadership, Sales Culture, Performance Systems, And Organizational Structure As Root Causes Of The Cross-Selling Scandal.” “In April 2017, the board of directors released the results of its independent investigation which sharply criticized the bank’s leadership, sales culture, performance systems, and organizational structure as root causes of the cross-selling scandal.” [Bryan Tayan, “The Wells Fargo Cross-Selling Scandal,” Harvard Law School Forum on Corporate Governance and Financial Regulation, 02/06/19]

The Report Said That Wells Fargo’s Management Knew Their Sales Targets Were “Unattainable,” And “Commonly Referred To As 50/50 Plans” Because It Was Expected That Only Half Of Wells Fargo’s Regional Divisions Would Be Able Meet Them. “‘In many instances, community bank leadership recognized that their plans were unattainable. They were commonly referred to as 50/50 plans, meaning that there was an expectation that only half the regions would be able to meet them.’” [Bryan Tayan, “The Wells Fargo Cross-Selling Scandal,” Harvard Law School Forum on Corporate Governance and Financial Regulation, 02/06/19]

The Board’s Report Blamed Management For Not Recognizing “‘The Relationship Between The Goals And Bad Behavior’” Of Wells Fargo Employees. “The report faulted management for failing to identify ‘the relationship between the goals and bad behavior [even though] that relationship is clearly seen in the data. As sales goals became more difficult to achieve, the rate of misconduct rose.’ Of note, the report found that “employees who engaged in misconduct most frequently associated their behavior with sales pressure, rather than compensation incentives.’” [Bryan Tayan, “The Wells Fargo Cross-Selling Scandal,” Harvard Law School Forum on Corporate Governance and Financial Regulation, 02/06/19]

The Board’s Report Found That Management Failed To Connect Wells Fargo’s Sales Practices, Employee Complaints, And Lawsuits In A “‘Systemic’” Way. “’Certain of the control functions often adopted a narrow ‘transactional’ approach to issues as they arose. They focused on the specific employee complaint or individual lawsuit that was before them, missing opportunities to put them together in a way that might have revealed sales practice problems to be more significant and systemic than was appreciated.’” [Bryan Tayan, “The Wells Fargo Cross-Selling Scandal,” Harvard Law School Forum on Corporate Governance and Financial Regulation, 02/06/19]

CEO Tim Sloan Apologized For The Fake Account Scandal And Vowed To Reform Wells Fargo—But His Company Has Not Shaken Its Aggressive Sales Culture.

In The Wake Of The Fake Account Scandal, Wells Fargo Initially Tried To Blame Employees And Fired 5,300 Of Them—But Tim Sloan Eventually Admitted That Its Workers Were Victims Of The Bank’s Intense Sales Culture.

In 2017, Wells Fargo CEO Tim Sloan Said The Bank Re-Hired Nearly 2,000 Of The 5,300 Workers Who Were Blamed And Fired For The Fake Account Scandal.

Wells Fargo Fired Around 5,300 Employees For Opening Fake Accounts, But “Many More Employees Left Or Were Pushed Aside Because They Could Not Abide The Culture.” “About 5,300 employees were fired for taking part in the misconduct, the bank has said, but many more employees left or were pushed aside because they could not abide the culture.” [Patrick Rucker, “Wells Fargo rehires workers pushed aside in accounts scandal,” Reuters, 10/02/17]

In 2017, Wells Fargo CEO Tim Sloan Claimed The Bank Re-Hired Almost 2,000 Workers Who Were Fired Or Quit In The Wake Of The Fake Accounts Scandal. “Wells Fargo & Co […] Chief Executive Officer Tim Sloan apologized for a phony accounts scandal and said the U.S. bank had hired back nearly 2,000 workers who had quit or were fired, according to prepared congressional testimony.” [Patrick Rucker, “Wells Fargo rehires workers pushed aside in accounts scandal,” Reuters, 10/02/17]

Wells Fargo CEO Tim Sloan Eventually Said The Bank “Failed Our Team Members,” That He Was “Deeply Sorry” For How They Were Treated, And He Apologized For “The Damage Done” To Them.

Wells Fargo CEO Tim Sloan Said He Was “Deeply Sorry For Letting Down” The Bank’s Workers And He Apologized For “The Damage Done” To Them. Wells Fargo CEO Timothy Sloan’s Prepared Testimony for a Senate Banking Committee Hearing On October 3, 2017 said, “I am deeply sorry for letting down our customers and team members. I apologize for the damage done to all the people who work and bank at this important American institution.” [Testimony of Timothy J. Sloan, “Wells Fargo: One Year Later,” Hearing of The U.S. Senate Committee on Banking, Housing and Urban Affairs, 10/03/17]

- Tim Sloan Said That Wells Fargo’s High-Pressure Tactics “Failed Our Team Members.” “The old sales goals and pressure failed our team members, too. Our new compensation and performance plan rewards retail team members for excellent customer service and team performance, not for selling products.” [Testimony of Timothy J. Sloan, “Wells Fargo: One Year Later,” Hearing of The U.S. Senate Committee on Banking, Housing and Urban Affairs, 10/03/17]

Tim Sloan Has Claimed That His Efforts To “Transform” Wells Fargo Are Making “Real” Progress.

Tim Sloan Contended That Wells Fargo Has Taken Major Steps To “Transform” Itself.

Tim Sloan Has Asserted That Wells Fargo Has Made Efforts To “Transform” The Company. In an op-ed, Sloan wrote, “In the past two years, with the full support of our Board of Directors, we have undertaken a massive effort to transform Wells Fargo.” [Tim Sloan, “Wells Fargo CEO: We’re proud of our progress,” The Charlotte Observer, 01/07/19]

Tim Sloan Said Wells Fargo Was Making “Real” Progress And, As Such, Pride In The Company Was Growing.

Tim Sloan Said Pride In The Company Was Growing As It Was Making “Real” Progress. Sloan said, “[…] our progress in the past two years is real and is continuing […] Our pride and dedication will only continue to strengthen and grow across Wells Fargo.” [Tim Sloan, “Wells Fargo CEO: We’re proud of our progress,” The Charlotte Observer, 01/07/19]

However, Wells Fargo’s Employees Still Complain About Intense Pressure Flout Ethics And Customers’ Best Interests In Order To Drive Sales.

In The Time Since The Fake Account Scandal, Wells Fargo Has Claimed That It Has Removed Its Aggressive Sales Targets, And That Its Employees’ Priority Should Be To “Serve Customers, Not Sell Them Things.”

Wells Fargo Has Claimed That It Has Removed Sales Targets For Employees, And That Their “Primary Job Is To Serve Customers, Not Sell Them Things…” “‘At the heart of its rehabilitation efforts, Wells Fargo said, it has changed how it motivates employees. No longer will they be individually rewarded for reaching sales targets, or punished for falling short. Branch workers were told that their primary job is to serve customers, not sell them things.” [Emily Flitter and Stacy Cowley, “Wells Fargo Says Its Culture Has Changed. Some Employees Disagree.,” The New York Times, 03/09/19]

…Yet Employees Have Argued That Wells Fargo’s Aggressive Sales Culture Has Merely Taken A Different Form.

…But Employees Argue That The Targets And Incentives Have Merely Changed, “Not Disappeared.” “But the sales incentives have changed, not disappeared, according to the current and former employees, who work in branches, loan-processing centers and other parts of the bank.” [Emily Flitter and Stacy Cowley, “Wells Fargo Says Its Culture Has Changed. Some Employees Disagree.,” The New York Times, 03/09/19]

Just This Month, The New York Times Reported That Wells Fargo’s Aggressive Sales Culture Persists, With Many Employees Still “Bending Or Breaking Internal Rules” To “Squeeze Extra Money Out Of Customers.”

Wells Fargo’s Employees Say They Are Still Pressured To “Squeeze Extra Money Out Of Customers,” With Some Workers “Bending Or Breaking Internal Rules To Meet Ambitious Performance Goals.” “[…] Wells Fargo workers say they remain under heavy pressure to squeeze extra money out of customers. Some have witnessed colleagues bending or breaking internal rules to meet ambitious performance goals, according to interviews with 17 current and former employees and internal documents reviewed by The New York Times” [Emily Flitter and Stacy Cowley, “Wells Fargo Says Its Culture Has Changed. Some Employees Disagree.,” The New York Times, 03/09/19]

In March 2019, The New York Times Reported That Wells Fargo’s Mortgage Processors Were Pressured “To Send Documents They Knew Contained Incorrect Information To Borrowers To Meet Internal Deadlines.” “Two mortgage-processing employees in Minneapolis said managers pressured their team to send documents that they knew contained incorrect information to borrowers to meet internal deadlines.” [Emily Flitter and Stacy Cowley, “Wells Fargo Says Its Culture Has Changed. Some Employees Disagree.,” The New York Times, 03/09/19]

Although Wells Fargo Branch Employees Are No Longer Directly Incentivized To Sell Products, They Are Now Urged To Refer Customers To Salespeople Who Often Do Not Serve The Customers’ Best Interests.