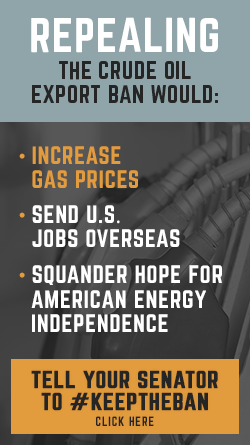

Fact Sheet: We Can’t Afford to Repeal the Crude Oil Export Ban

Higher Gas Prices. American Jobs Sent Overseas.

Chance for U.S. Energy Independence Squandered.

For 40 years, the crude oil export ban has mostly forbidden big oil companies from shipping American crude oil to other countries. The policy has protected American consumers, kept good-paying refinery jobs here in the United States, and set America on a path toward energy independence.

For 40 years, the crude oil export ban has mostly forbidden big oil companies from shipping American crude oil to other countries. The policy has protected American consumers, kept good-paying refinery jobs here in the United States, and set America on a path toward energy independence.

Big oil, however, is hard at work encouraging Congress to repeal the ban. Such a move would pad the bottom line of oil companies already bringing in billions of dollars in profit each year while also strengthening the economies of foreign countries like China. Unfortunately, the American people would not fare as well by such a change in policy. Experts estimate lifting the ban could raise gas prices by as much as 14.5 cents per gallon, cost thousands of American jobs, and hold our national security and energy independence hostage to foreign oil suppliers in the Middle East.

Congress should reject big oil’s attempt to undermine the economic security of hardworking Americans and vote against any effort to repeal the crude oil export ban.

Lifting the Ban Will Result in Higher Gas Prices

If Big Oil Companies Take U.S. Oil Overseas, Gas Prices Will Go Up: Opponents of lifting the oil export ban argue that lifting it could “raise the price of U.S. gasoline…” They argue, “if oil producers can sell abroad, prices would presumably rise.” (The Washington Post, 01/09/14)

Americans Could Spend $10 Billion More for Gas Each Year: “Barclays Plc. predicts that lifting the export ban could increase total spending on motor vehicle fuel by $10 billion a year. Sandy Fielden, director of energy analytics at RBN Energy, told Bloomberg that if there are more oil exports, ‘the most obvious thing that’s going to happen is that crude prices will go up and so will gasoline.’” (Congressional Testimony by Daniel Weiss of the Center for American Progress, 01/30/14)

Average U.S. Gas Prices Could Increase by As Much As 14.5 Cents Per Gallon: According to consulting firm Stancil & Co., “ending the decades-old ban would raise gasoline prices. The study by Alan Stevens, president of consulting firm Stancil & Co., predicted an average gas price increase of 8.4 cents to 14.5 cents per gallon if domestic oil producers are allowed to ship their products overseas.” It concluded, “‘allowing the export of crude would cause domestic gasoline, jet fuel, diesel, and heating oil prices to increase.’” (The Hill, 07/27/15)

Small Businesses and Families Would Be Exposed to Higher Prices: “Allowing crude oil exports at a time when U.S. oil demand is rising and U.S. oil production is set to decline is bad policy, and will leave the American economy vulnerable to increased reliance on imports, exacerbating exposure of families and small businesses to higher prices,” according to Public Citizen. (Congressional Testimony by Tyson Slocum of Public Citizen, 06/17/15)

Experts Say American Consumers Will Pay More: “A recent study by the Energy Information Agency (EIA) predicts…America will import more foreign crude if the oil export ban is lifted. Domestic crude prices likely would rise to global levels, and with too-high crude prices, consumers will pay more.” (United Steelworkers)

U.S. Oil Sold Overseas Means Expensive Oil Must Be Imported – That Means Higher Gasoline Prices: EIA “predicts that in 2014 the U.S. will consume 5 million barrels per day (MBD) of oil and liquids more than we produce. This gap between demand and supply will continue at least through 2040, ultimately growing by 13 percent. Domestic oil sold overseas must be replaced by more expensive imported oil. This higher price could be reflected in higher gasoline prices.” (Congressional Testimony by Daniel Weiss of the Center for American Progress, 01/30/14)

Lifting the Ban Will Send Our Jobs Overseas

Experts Say U.S. Jobs Will Be Lost: A recent study by EIA predicts that if the oil export ban is lifted “domestic refining jobs will be lost.” (United Steelworkers)

Lifting the Ban Will Benefit Workers…Outside the United States: Refinery workers in the United States “stand to lose from lifting export limits.” Lifting the oil export ban will benefit refinery workers outside the United States “at the expense of thousands of American jobs,” according to Delta Air Lines. (Congressional Testimony by Graeme Burnett from Delta Air Lines, 01/30/14)

Companies Will Have an Incentive to Move Jobs Offshore: According to United Steelworkers, “refinery and related industry occupations are good-paying, middle class jobs which support over $1.8 million in value added to the economy per employee. That means jobs that support families and sustain local economies and communities. Lifting the crude oil ban would provide an incentive for companies to move refining offshore, causing the loss of valuable U.S. refinery jobs and have a devastating ripple effect throughout the economy. The U.S. should be self-sufficient and refine as much of its domestic crude as possible.” (United Steelworkers)

U.S. Refining Capacity Will Drop and Good American Jobs Will Be Lost: According to the CRUDE Coalition, if the ban is lifted oil companies will export oil, “unrefined, to places with growing demand like China, projected to be the main source of global demand growth in 2015 and 2016. Some integrated firms will export to…[overseas] refiners, bypassing American refining competitors. We’ll see more petroleum products refined…[overseas] but derived from American crude returning to our shores. If this were to happen, American refining capacity will drop, and good American jobs will be lost and the economic activity and energy security that are derived from increased domestic production will be minimized.” (Congressional Testimony by Jeffrey Warmann of Monroe Energy Inc. on Behalf of the CRUDE Coalition, 03/19/15)

Lifting the Ban Threatens Hope for American Energy Independence

Squandering an Historic Opportunity for Energy Independence: “‘We’re on the cusp of a historic opportunity – finally – to gain energy independence and security, and break through the grip of foreign oil cartels on the U.S. economy,’ said Jeff Peck, the lobbyist hired to lead” the CRUDE Coalition’s government outreach against lifting the oil export ban. (The Houston Chronicle, 03/18/14)

With Tensions High in the Middle East, Lifting Ban Could Be Dangerous: According to the AFL-CIO, “America should never again be held hostage to foreign oil suppliers, and with tensions in the Middle East higher than they have been in decades, moving now to lift the ban on exporting crude oil is foolhardy and dangerous.” (AFL-CIO, Executive Council Statement, 07/30/14)

Exporting U.S. Oil to Place Like China While Importing Oil From Places Like the Middle East: According to the CRUDE Coalition, “America is producing a lot of crude oil, but…we’re importing more foreign oil than we did 40 years ago when the ban was first enacted! We import 7 million barrels of foreign oil a day, including over 3 million per day from the Middle East. For every barrel of oil exported, that would mean one more barrel of oil we would have to import – increasing, not decreasing, our dependence on foreign producers. Exporting oil to places like China, while importing more oil from the Middle East, only undermines our national security.” (CRUDE Coalition)

Lifting the Ban Would Benefit China: “Kirk Lippold, a retired US Navy commander who is a strategic planning consultant,” thinks “the number one beneficiary of lifting the ban is likely to be China.” (Oil & Gas Journal, 07/10/15)

Reliance on Foreign Oil Could Have Devastating Effects: Retired US Navy Commander Kirk Lippold recently said, “I have experienced – particularly in my command of the USS Cole when it was attacked by al-Qaeda terrorists – the devastating effects of reliance on imported oil when our assets are placed in harm’s way. The United States must protect its own interests first. Only then can we enjoy the benefits of a prosperous economy, low gas prices and strong alliances that contribute to international stability. The United States someday may be in a position to change its crude oil export policy, but for the sake of national security, that day is not today.” (The Washington Post, 08/09/15)