TODAY: Senate GOP Could Vote to Endorse Discrimination at Nation’s Largest Auto Dealers

As Senate considers revoking the CFPB’s protections from discriminatory auto lending practices, report examines other accusations of discrimination America’s auto industry have faced.

Table of Contents

- EXECUTIVE SUMMARY

- DISCRIMINATION AT AMERICA’S LARGEST AUTO-DEALERS

- AUTONATION

- PENSKE AUTOMOTIVE GROUP

- GROUP 1

- LITHIA MOTORS

- SONIC AUTOMOTIVE

- HENDRICK AUTOMOTIVE GROUP

- ASBURY AUTOMOTIVE GROUP INC.

- KEN GARFF AUTOMOTIVE GROUP

- LARRY H. MILLER DEALERSHIPS

- STALUPPI AUTO GROUP

EXECUTIVE SUMMARY

In March 2013, the CFPB issued guidance to the indirect auto lending industry, “warning that it would cite lenders for fair lending violations if their partners discriminate against any protected class, regardless of whether the discrimination was intentional[1].” The bulletin cited “evidence that African Americans and Hispanics paid higher rates” on auto loans.[2]

Specifically, the guidance targeted a practice known as “dealer markup,” in which “banks function as indirect lenders,” allowing “dealers to add to the interest rate the banks charge and pocket the difference.” Consumer advocates argue “the practice gives dealers an incentive to move buyers into more-expensive loans, and that minorities are at greater risk of this treatment.”[3]

As soon as today, the Senate could vote to reverse these safeguards. If approved, the move would eliminate guidance “intended to discourage discrimination in auto lending” and create precedent that puts “protections for workers, consumers, minorities and the environment” as well as “regulatory certainty for businesses” at risk.[4]

This report looks at accusations of discrimination at some of America’s largest auto-dealers.

DISCRIMINATION AT LARGEST U.S. AUTO-DEALERS

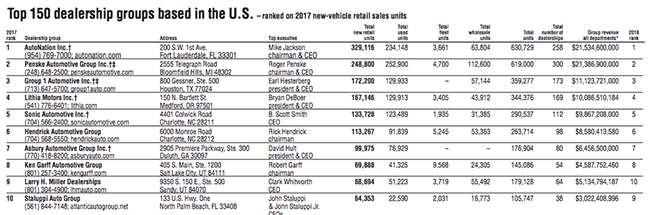

Annually, Automotive News releases its list of the “largest auto retail groups based in the United States, ranked by unit sales of new vehicles” during the previous year. The list is compiled based on surveys sent to participating auto dealership groups.

In 2017, the Top 10 were:

Source: http://www.autonews.com/assets/PDF/CA114804323.PDF

AUTONATION

In 2002, an arbitrator “ordered AutoNation Inc. and its Huntington Beach Ford dealership to pay $130,000 to a former salesman who claimed he was fired after he complained” about customers having their interest rates “inflated without their knowledge.”

In 2003, “an arbitrator… ordered AutoNation Inc. and its Huntington Beach Ford dealership to pay $130,000 to a former salesman who claimed he was fired after he complained about customers being overcharged. The complaints stemmed from deals in which customers’ interest rates were allegedly inflated without their knowledge. Although the company investigated his complaints and ordered that the offending practices cease, the salesman claimed that he was still punished and ultimately terminated for speaking out. AutoNation has stated that it will appeal the arbitrator’s award.” [Ogletree, Deakins, Nash, Smoak & Stewart, P.C., “Recent cases demonstrate risks of retaliation claims,” California Employment Law letter, 11/25/02]

Just the next year, in 2003, a subsidiary of AutoNation was accused of charging an “elderly man” an interest rate five percentage points higher than the rate approved by Bank of America.

In 2003, “Sharon Kinsey, an attorney in Soquel (Santa Cruz County) [was] pursuing a lawsuit in Alameda County Superior Court on behalf of an elderly man who was approved by Bank of America for a 12.5 percent loan to buy a 1993 Dodge Shadow priced at $7,200, but was charged 17.5 percent by the dealer, Hayward Dodge.”

“Hayward Dodge and its attorney declined to comment on the case, referring calls to corporate headquarters of its owner, AutoNation, in Florida, which did not return them.” [Caroyln Said, “Minorities charged higher rates for car loans / State senator plans to introduce a remedy,” SF Gate, 01/26/03]

The Equal Employment Opportunity Commission (EEOC) has pursued several lawsuits against AutoNation Inc. and its subsidiaries for accusations of racial and sexual discrimination since 1999.

In 1999, The EEOC sued a company AutoNation owned for “alleged discrimination based on race and natural origin” when they alleged that “a black salesman from Nigeria was continually referred to as ‘Ebola virus.'”

In 1999, “The Equal Employment Opportunity Commission sued Charlie Thomas Ford in federal court… for alleged discrimination based on race and natural origin, contending that a black salesman from Nigeria was continually referred to as ‘Ebola virus.'”

“AutoNation, owners of Charlie Thomas Ford, believe[d] the lawsuit [was] without merit, said Oscar Suris, manager of corporate communications for the Fort Lauderdale, Fla.-based company. He declined to elaborate.”

Some employees claimed they “didn’t know [Employee James] Eboka’s real name… because the taunting was so frequent” and Eboka’s lawyer said that “Eboka was even called ‘Ebola virus’ in front of customers to discourage them from doing business with him.” [L.M. Sixel, “Ford dealership accused of bias; EEOC sues, claiming former salesman was called ‘Ebola virus'” The Houston Chronicle, 09/18/99]

In 2005, the EEOC “filed a class-action lawsuit in Chicago against AutoNation Inc., alleging that the auto retailer subjected employees” at one of its dealerships “to racial, national origin and religious harassment.” One employee said he was “routinely harassed” because he was Muslim and alleged that management referred to him as “‘camel jockey, towel head and bomb thrower'” while he worked as a sales associate.

In 2005, The Washington Post reported that “the EEOC filed a class-action lawsuit in Chicago against AutoNation Inc., alleging that the auto retailer subjected employees at its Elmhurst, Ill., Kia dealership to racial, national origin and religious harassment. The EEOC suit was based on a complaint of discrimination filed by Halit Macit, a former sales associate with AutoNation, who said he was routinely harassed by a manager based on his Muslim religion and Turkish national origin.” [Amy Joyce, “The Bias Breakdown,” The Washington Post, 12/09/05]

Specifically, “The U.S. Equal Employment Opportunity Commission filed a lawsuit against car retail giant AutoNation Inc… for the alleged racial discrimination a Turkish-Muslim employee was subjected to at its former Kia dealership in Elmhurst. Halit Macit was often called ‘camel jockey, towel head and bomb thrower’ by management while he worked as a sales associate at the store during a 6-month period between 2002 and 2003, EEOC trial attorney Aaron DeCamp said.” [“Metro Briefs”, Chicago Sun-Times, 12/09/05]

The next year in 2006, the EEOC sued AutoNation after a black salesman was subject “to a racially hostile work environment” at one of the company’s Ohio dealerships. The EEOC further alleged that the “dealership retaliated against [the employee] for complaining.”

In 2006, the EEOC filed a suit “against AutoNation Inc., the parent company of Mullinax Ford North Canton. The EEOC claimed that Avery Williams, a black used-car salesman at Mullinax, was subjected to a racially hostile work environment and that the dealership retaliated against him for complaining.” AutoNation denied the accusations. [Christopher Jensen, “EEOC sues Spitzer over civil rights complaints,” Cleveland Plain Dealer, 09/29/06]

That same year, an employee of a Colorado AutoNation dealer sued the dealer alleging gender discrimination in US District Court, claiming she got fired for announcing she was pregnant.

“Andrea Wolff-Yakubovich, a former finance director for a John Elway AutoNation dealer, [claimed] she got the boot three weeks after she announced that she was pregnant.”

Wolff-Yakubovich claimed that her boss asked her husband, who also worked at the dealership, “‘Why would Andye want to be in the car business… She should just be at home barefoot and pregnant.'”

In 2006, Wolff-Yakubovich went to U.S. District Court and sued for discrimination, “alleging the… comments as part of her claim.” AutoNation denied her claims and said, “‘We acted appropriately.'” Adding, “‘We will vigorously defend ourselves when it goes to trial.'” [Dow Jones Newswires and Al Lewis, “Pregnancy shouldn’t cost women jobs,” Denver Post, 10/14/06]

In 2017, the EEOC sued AutoNation for sex discrimination when an employee of one of their Florida dealerships “accused AutoNation of failing to promote her because she’s a woman.”

“The U.S. Equal Employment Opportunity Commission (EEOC) [sued] AutoNation Inc. for sex discrimination that allegedly took place at the AutoNation Chevrolet Coral Gables in the summer of 2013. The federal agency last week filed a complaint against the Fort Lauderdale-based automotive retailer in the U.S. District Court for the Southern District of Florida for conditions that allegedly led Jacqueline de la Torre being passed over for a promotion at the dealership. The EEOC has accused AutoNation of failing to promote her because she’s a woman, a violation of the Title VII the Civil Rights Act of 1964. AutoNation Chief Marketing Officer Marc Cannon said the company disputes the allegations and it believes they are ‘not with merit.'” [Emon Reiser, “EEOC sues AutoNation for alleged sex discrimination,” South Florida Business Journal, 10/02/17]

PENSKE AUTOMOTIVE GROUP

In 2016, a former employee of Penske Automotive Group sued Penske alleging that he was “subjected to discrimination, harassment, and retaliation during the course of his employment, based on the conduct of his direct superior.” The allegations “included his being repeatedly berated with homophobic slurs, physically threatened, as well as being present during the making, and within earshot of, anti-Semitic and racist comments directed at other employees and customers.”

In 2016, a man formerly employed by Penske Automotive Group, “as a portfolio manager, allege[d] that he was subjected to discrimination, harassment, and retaliation during the course of his employment, based on the conduct of his direct superior, Scott Giarraffa. Those allegations included his being repeatedly berated with homophobic slurs, physically threatened, as well as being present during the making, and within earshot of, anti-Semitic and racist comments directed at other employees and customers.” The former employee also alleged that “while he repeatedly reported these instances of misconduct to upper management, they were neither investigated nor remediated, and the offending supervisor was not disciplined or terminated.” [Final Opinion, Daniel J. Ladeairous v. Toyota Motor Sales et.al., SUPERIOR COURT OF NEW JERSEY LAW DIVISION MIDDLESEX COUNTY DOCKET NO. 3891-16, 11/14/16]

GROUP 1 AUTOMOTIVE INC.

After receiving letters warning of potential discriminatory lending practices at his company, the Vice President of Financial Services and Manufacturer Relations at Group 1 Automotive said “there were so few [instances of discrimination],” and the pricing differences “were so ‘insignificant,’ that Group 1 [didn’t] expect to make any changes to its policies” despite being alerted to the issues.

In the wake of CFPB’s initial auto-lending guidance, “Auto lenders [began] peppering dealerships with letters that say analyses of the dealerships’ practices indicate a pattern of discrimination against minorities, women or the elderly in the loans they arrange for those customers.”

“Dealers, lawyers and others who have seen the lenders’ letters said they allege patterns of discrimination against several categories of consumers based on race, ethnicity, gender and age.”

“Pete DeLongchamps, vice president of financial services and manufacturer relations at Group 1 Automotive Inc. in Houston, said his company’s 139 dealerships got a few letters from lenders, but he said there were so few, and the amounts of alleged disparity in pricing were so ‘insignificant,’ that Group 1 [didn’t] expect to make any changes to its policies.” [Jim Henry and Jamie LaReau, “Lenders warn dealers about bias Letters question retailers’ markup,” Automotive News, 10/02/13]

A former employee “in a car dealership’s finance department,” who was “a Muslim American of Palestinian descent,” brought a lawsuit against Group 1 Automotive in which he claimed he’d been subjected to a “hostile work environment, discrimination based on age, religion, and national origin.” The employee claimed he was subjected to blatant racism by his supervisor at the dealership, who “referred to him as a ‘towelhead’, ‘raghead’, ‘rock thrower’, ‘sand nigger’, ‘terrorist’, ‘f***ing Palestinian’ and ‘f***ing Muslim’ and other similar epithets three to four times a week.”

In Alzuraqi v. Group 1 Automotive, Inc. (2013), “Mr. Alzuraqi was a 51-year old employee in a car dealership’s finance department and a Muslim American of Palestinian descent. He was also the oldest employee of the car dealership. Alzuraqi’s supervisor referred to him as a ‘towelhead’, ‘raghead’, ‘rock thrower’, ‘sand nigger’, ‘terrorist’, ‘f***ing Palestinian’ and ‘f***ing Muslim’ and other similar epithets three to four times a week, on one occasion, the supervisor told the employee that he was glad that the employee wasn’t going to have any more kids, because that meant ‘fewer Palestinian children in the world.’ Another time, the supervisor stood in the hall outside the employee’s office and complained that the Persian food purchased by a coworker of the employee for lunch smelled like ‘f***ing camel s**t.’ The supervisor also referred to Alzuraqi as ‘old man’ or ‘old fart’ and would state that Alzuraqi was unable to remember something because he was ‘old.’ Such incidents occurred approximately one to two times per week. Alzuraqi was eventually fired and he brought an action under the ADEA and Title VII for hostile work environment, discrimination based on age, religion, and national origin. The court held that, with regard to the employee’s ADEA claims, Alzuraqi had not proved a hostile work environment existed under the ADEA because unlike Title VII, the ADEA does not recognize mixed-motives age discrimination claims. In order for the employee to prevail in his ADEA claim, he would have had to prove that that his age was the ‘but-for’ cause of the challenged adverse employment action.” [Henry Findley et. al., “Age-Based Hostile Environment,” Journal of Business and Behavior Sciences, Fall 2015]

LITHIA MOTORS INC.

In March 2018, a female employee accused Lithia Motors of sexual harassment in a lawsuit in which she claimed, “she was denied equal pay, routinely sexually harassed by two store managers and wrongfully fired while on medical leave.”

In 2018 it was reported that “Evette Burgess, who worked at BMW of Spokane, claims she was denied equal pay, routinely sexually harassed by two store managers and wrongfully fired while on medical leave. The BMW retailer… is part of Oregon-based Lithia Motors Inc., which has about 200 employees at four stores in the Spokane area. Lithia says one of the managers was fired for his behavior, and the other was disciplined.” [Chad Sokol, “Red Lion Hotels, Lithia Motors face lawsuits involving sexual harassment claims,” The Spokesman-Review, 03/09/18]

In 2006, Lithia Motors settled two racial discrimination lawsuits in Colorado and Oregon. The suits concerned “three African American former employees the EEOC said were targeted for harassment and retaliation” and “a suit brought on behalf of a salesman from Iran, who the EEOC said was harassed by a new management team, and his white supervisor, who the EEOC said was fired in retaliation for speaking out against discrimination.”

In 2006, “The U.S. Equal Employment Opportunity Commission announced… that a federal court in Colorado ha[d] approved a $562,500 settlement of a race discrimination lawsuit brought against Lithia Motors Inc. of Medford and a car dealership it owns in Aurora, Colo.”

“The announcement [came] a week after the commission announced that an Oregon federal court had approved a $360,000 settlement with Lithia Subaru of Oregon City, also owned by Lithia Motors.”

“The Colorado settlement end[ed] a workplace discrimination lawsuit brought on behalf of three African American former employees the EEOC said were targeted for harassment and retaliation. The Oregon settlement end[ed] a suit brought on behalf of a salesman from Iran, who the EEOC said was harassed by a new management team, and his white supervisor, who the EEOC said was fired in retaliation for speaking out against discrimination.”

“In both cases, the commission said, internal investigations by Lithia Motors found no problems. ‘A common thread is the company investigated and failed to find any evidence of discrimination,’ said Carmen Flores, a spokeswoman for the EEOC in Seattle. ‘This company needs to pay close attention to these investigations.'”

“An attorney for Lithia said… that those who were alleged to have practiced discrimination no longer worked for the company.” [Jonathan Brinckman, “Lithia settles Colorado discrimination suit,” The Oregonian, 03/17/06]

SONIC AUTOMOTIVE INC.

A subsidiary of Sonic Automotive was sued by an employee who claimed he was unlawfully fired for reporting instances of racial discrimination against minorities “in the extension of credit.” The employee, Steven A. Calderone, reported the alleged activity to his supervisors and claims he was terminated due to his reporting.

“Sonic Houston JLR, LP operates as a subsidiary of Sonic Automotive of Nevada, Inc.” Sonic Automotive of Nevada, Inc. is itself a subsidiary of Sonic Automotive, Inc. of Charlotte, NC. [Sonic Houston JLR, LP, Bloomberg and Sonic Automotive of Nevada, Inc., accessed 04/17/18]

In 2017, Sonic Houston JLR, LP was sued by Steven Calderone, who claimed “he was unlawfully terminated under the Consumer Financial Protection Act (“CFPA”) for reporting racial discrimination in the extension of credit.”

“Sonic, a car dealership, employed Calderone as a salesman. Calderone alleges that Sonic refused to extend financing or sell cars to customers who were members of racial minorities. Calderone reported the discrimination to supervisors, managers, and eventually the human resources department and was allegedly terminated for those actions.”

Calderone brought the lawsuit under the “Dodd-Frank Wall Street Reform and Consumer Protection Act.” The court entered a summary judgment in favor of Sonic Automotive on the grounds that Sonic Automotive was not subject to regulations under Dodd-Frank, including prohibitions on retaliation against whistleblowers. [Calderone v. Sonic Houston JLR, 2018 U.S. App. LEXIS 532]

In 2003, Sonic Automotive was the subject of an NBC “Dateline” investigation, which “showed employees who deceived customers about the cost of cars and other irregularities.”

In 2003, the North Carolina Attorney General’s Office probed “Charlotte-based Sonic Automotive Inc.’s sales practices” after a report on NBC’s “Dateline” which “aired the results of an investigation that took hidden cameras last spring into Town and Country Ford, Sonic’s flagship dealership in Charlotte” and “showed employees who deceived customers about the cost of cars and other irregularities.” [“Attorney General in Sonic Probe,” Charlotte Business Journal, 12/10/03]

HENDRICK AUTOMOTIVE GROUP

In February 2018, thirty-three “former sales associates” sued Hendrick Automotive Group, “alleging they were cheated out of commissions at its Chevy dealership in Naples,” Florida. The plaintiffs alleged that “the dealership, at the direction of Hendrick, engaged in deceptive and deceitful practices to manipulate its sales numbers so it could pay lower commissions – and that it refused to provide an accounting of their deals.”

In February 2018, a group of thirty-three “former sales associates” sued Hendrick Automotive Group, “alleging they were cheated out of commissions at its Chevy dealership in Naples,” Florida. The lawsuit was “filed in Collier Circuit Court against the automotive group and its dealership, operating under the name Naples CH LLC.” The plaintiffs, who sought “a class-action status,” alleged that “they were deliberately deprived of their commissions because of a policy and practice that added “fictitious or wildly inflated costs” to deals, resulting in the lowest possible payouts to sales associates.” The plaintiffs alleged that “the dealership, at the direction of Hendrick, engaged in deceptive and deceitful practices to manipulate its sales numbers so it could pay lower commissions – and that it refused to provide an accounting of their deals.” [Laura Layden, “Former sales associates sue Hendrick Automotive,” Naples Daily News, 03/10/18]

In 2009, Hendrick Automotive Group “settled with a class of about 20,000 customers who were deceptively sold an add-on car coating called ‘Car Care.'” One plaintiff said “‘he paid $740 for the treatment on a new Acura when the actual cost to the dealer was only $35.'”

In 2009, Hendrick Automotive Group “settled with a class of about 20,000 customers who were deceptively sold an add-on car coating called ‘Car Care.’ According to one report, ‘One plaintiff in the lawsuit says he paid $740 for the treatment on a new Acura when the actual cost to the dealer was only $35.’ The plaintiffs were able to obtain a settlement of $5 million on behalf of the class, which represented a payout to class members of about $195 per car bought.” The case was Mills v. Hendrick Automotive Group, et al., (2009) Case No. 04 CVS 2301 (Super. Ct. N.C. 2004-2009).” [Joanne Doroshow, “First Class Relief: How Class Actions Benefit Those Who Are Injured, Defrauded and Violated,” Center for Justice & Democracy at New York Law School, October 2014]

In April 1997, Hendrick Automotive Group “was hit with an $815,000 jury verdict” in a sexual harassment lawsuit involving an Oakland, California auto dealership it owned from 1993 to 1994.” Hendrick “denied turning a blind eye on any harassment,” but the dealership’s former finance manager testified that its former sales manager “frequently used sexually abusive language” and “exposed himself to her outside her office.” The plaintiff alleged that the sales manager “consistently was abusive to women,” including rating the anatomy of female customers and having “‘a stripper at a party for another manager in the middle of the showroom in the middle of the business day.'”

In April 1997, Hendrick Automotive Group “was hit with an $815,000 jury verdict…in a sexual harassment lawsuit involving an Oakland, California auto dealership it owned from 1993 to 1994.” Hendrick “denied turning a blind eye on any harassment,” but Joann McQuagge, the former finance manager at the Oakland dealership, “testified that the dealership’s former sales manager, Richard McMaster, frequently used sexually abusive language” and “exposed himself to her outside her office.” McQuagge’s attorney said that McMaster “consistently was abusive to women. ‘When women customers came in, he’d sit around with other managers and rate their anatomy,’ Bennett said. ‘He even had a stripper at a party for another manager in the middle of the showroom in the middle of the business day.'” [Ilana DeBare, “Car Dealer Loses Harass Suit; Company supposedly ignored misconduct reports at Oakland dealership,” The San Francisco Chronicle, 04/23/97]

In March 2009, Joseph Rizzo and Gary Babich filed a class action lawsuit against Hendrick Automotive Group alleging that the company’s fee collection efforts were unlawful under Missouri law.

In March 2009, Joseph A. Rizzo and Gary M. Babich filed a class action lawsuit against Hendrick Automotive Group Corporation, Inc. in the U.S. District Court for the Western District of Missouri, Western Division. The two plaintiffs “purchased used automobiles from Hendrick Automotive Group Corporation, Inc.” and were charged “a ‘Doc Fee’ of $299.95” and “an ‘Administration Fee’ of $399.00,” respectively. The plaintiffs alleged “that the collection of the aforementioned fees by Hendrick violated Mo. Rev. Stat. §§ 407.010, et seq., 484.010, et seq., dealing with the unauthorized practice of law.” [Babich v. Hendrick Auto. Grp. Corp., 2009 U.S. Dist. LEXIS 138654]

In September 2010, Raymond A. Johnson filed a lawsuit against Hendrick Automotive Group, alleging that he was discriminated against “while he was employed as a car salesman with Hendrick Honda” in Charlotte, North Carolina. The plaintiff alleged age discrimination, race discrimination and retaliation, and sexual harassment, among other claims.

In September 2010, Raymond A. Johnson filed a lawsuit against Hendrick Automotive Group, alleging that he was discriminated against “while he was employed as a car salesman with Hendrick Honda” in Charlotte, North Carolina. “After construing the allegations broadly, the Court agrees that it appears Plaintiff has asserted, at best, the following ten claims against Defendant: (1) age discrimination; (2) race discrimination and retaliation; (3) retaliatory termination in violation of N.C. Gen. Stat. § 95-241; (4) alleged violations of N.C. Gen. Stat. § 95-25.6, pertaining to payment of wages; (5) retaliation for filing a workers’ compensation claim; (6) being forced to take unwanted medical leave related to his workers’ compensation injuries; (7) sexual harassment; (8) hostile work environment (threats made by coworkers; attending parties where gambling took place and alcohol was served); (9) unfair and deceptive trade practices; and (10) breach of settlement agreement and release.” [Johnson v. Hendrick Auto. Group, 2010 U.S. Dist. LEXIS 95222]

ASBURY AUTOMOTIVE GROUP INC.

In 2008, a federal jury awarded $19 million to four former employees of an Oregon Toyota dealership owned by Asbury Automotive Group “for enduring a hostile, racially charged work environment.” The plaintiffs, who were African-American, “claimed they lost car deals because of their race.” Witnesses described how dealership employees “used racist epithets” and “intentionally steered a white customer away from one of the plaintiffs” because of his race.

In August 2008, “a federal jury in Portland [Oregon] awarded $19 million Wednesday to four African American former employees of Thomason Toyota in Gladstone for enduring a hostile, racially charged work environment. Four salesman “sued in 2006 after they said managers and other workers at the dealership created an atmosphere of racist remarks that management failed to stop.” The “verdict was against the dealership’s former owner, the New York-based Asbury Automotive Group, which bought a majority stake in Thomason and its nine new-car dealerships in 1998” and “sold the dealership before the lawsuit was filed in 2006.”

“Several witnesses claimed that a supervisor repeatedly described himself as a ‘redneck’ and threatened to put a bullet in the head of anyone who complained. […] Another employee ‘talked about how his parents are rednecks and they don’t like blacks and they used to burn crosses,’ according to witness statements. Another dealership employee used racist epithets, according to witness statements. A dealership employee intentionally steered a white customer away from one of the plaintiffs because the customer ‘was a redneck and didn’t want to deal with him because he is black,’ according to witness statements. The four plaintiffs claimed they lost car deals because of their race.” [Ashbel S. Green, “Ex-car salesmen win $19 million,” The Oregonian, 08/28/08]

KEN GARFF AUTOMOTIVE GROUP

In 2009, Californians Against Hate, “a California gay-rights group,” boycotted Ken Garff Automotive Group after “Garff family matriarch” Katharine Garff (mother of current CEO John Garff) donated $100,000 “in support of Proposition 8, California’s same-sex marriage ban.” The boycott ended two weeks later, “following a series of meetings that included face-to-face discussions between company principals John and Robert Garff and Utah philanthropist Bruce Bastian, a leading gay-rights advocate.”

In 2009, Californians Against Hate, “a California gay-rights group,” “called for a boycott of Ken Garff Automotive Group’s 53 dealerships in six states in retaliation for a $100,000 donation made by Garff family matriarch Katharine Garff in support of Proposition 8, California’s same-sex marriage ban.” The boycott formally ended two weeks later, “following a series of meetings that included face-to-face discussions between company principals John and Robert Garff and Utah philanthropist Bruce Bastian, a leading gay-rights advocate.” CEO John Garff “insisted that his mother’s $100,000 donation was a personal gesture and in no way reflected the company’s political stance.” [Tony Semerad, “Gay-rights group drops boycott against Garff,” The Salt Lake Tribune, 02/27/09]

In April 2007, Ken Garff Automotive Group pulled “a series of television commercials” off the air “after formal complaints from at least two Asian-American groups.” In the “the Asian-themed commercials for its Honda cars,” “a person would ask a character representing Chinese philosopher Confucius a question, and a voice in broken English would answer.” Asian-American advocates called the commercials “‘insensitive and inappropriate,'” “‘unacceptable,'” “‘very hurtful,'” and “‘offensive.'”

In April 2007, Ken Garff Automotive Group pulled “a series of television commercials that used a character representing Confucius, […] after formal complaints from at least two Asian-American groups.” In the “the Asian-themed commercials for its Honda cars,” “a person would ask a character representing Chinese philosopher Confucius a question, and a voice in broken English would answer.” In a letter to Ken Garff Automotive Group, “Chinese-American community leader” Michael Kwan wrote, “‘It is as offensive to Confucian believers for your company to invoke Confucius as a method to sell your products as it would be to the LDS [Church of Jesus Christ of Latter-day Saints] faithful had you invoked Joseph Smith or Jesus Christ for crass commercial purpose.'” Others called the commercials “‘ insensitive and inappropriate,'” “‘unacceptable,'” “‘very hurtful,'” and “‘offensive.'” [Jennifer W. Sanchez, “TV spots pulled after complaints of ethnic insult,” The Salt Lake Tribune, 04/07/07]

LARRY H. MILLER DEALERSHIPS

In March 2007, a federal jury “awarded more than $3 million” to two women who “were fired from a Denver car dealership owned by The Larry H. Miller Group because they reported being sexually harassed.” The plaintiffs alleged that “a general manager had repeatedly tried to touch them, made lewd comments and referred to their business meetings as ‘cookie breaks'” and that they were fired “when they reported their treatment to the human resources department.”

In March 2007, a federal jury “awarded more than $3 million” to “two women who claimed they were fired from a Denver car dealership owned by The Larry H. Miller Group because they reported being sexually harassed.” The plaintiffs filed the lawsuit in 2003, alleging that “a general manager had repeatedly tried to touch them, made lewd comments and referred to their business meetings as ‘cookie breaks.'” They claimed, “that when they reported their treatment to the human resources department, they were fired.” [Pamela Manson, “Two women get $3M in harassment suit,” The Salt Lake Tribune, 03/06/17]

STALUPPI AUTO GROUP

In June 2015, a Las Vegas Nissan dealership owned by John Staluppi Jr. settled Federal Trade Commission charges that it used “deceptive ads to promote the sale or leasing of [its] vehicles, including advertising heavily discounted prices that were not generally available to consumers.” The dealership’s “deceptive ads” included “prominent offers for ‘PURCHASE! NOT A LEASE!’ when in fact, many of the offers were for leases.”

In June 2015, JS Autoworld, Inc., doing business as Planet Nissan, agreed to settle Federal Trade Commission charges that it used “deceptive ads to promote the sale or leasing of [its] vehicles, including advertising heavily discounted prices that were not generally available to consumers.” Planet Nissan’s “deceptive ads” included “prominent offers for ‘PURCHASE! NOT A LEASE!’ when in fact, many of the offers were for leases.” The dealership’s ads “also failed to disclose the amount of a down payment required, and the terms of repayment.” [“Two Las Vegas Auto Dealers Settle FTC Charges They Deceptively Advertised the Cost of Their Cars,” Federal Trade Commission, 06/29/15]

The principal of JS Autoworld, Inc. was John Staluppi Jr. In a statement, Staluppi said, “‘We weren’t as clear as we could have been about the terms of some of our offers […] It has always been our intent to provide consumers with accurate and complete information in an attempt to help every consumer obtain favorable terms for financing.'” [Jamie LaReau, “Two Las Vegas dealerships settle deceptive advertising charges,” Automotive News, 06/29/15]

In February 2010, a former employee filed a lawsuit against Atlantic Hyundai, owned by John Staluppi, alleging racial discrimination by the dealership’s management. The plaintiff alleged that a manager “both made and tolerated remarks evoking a discriminatory attitude toward Puerto Ricans and Hispanics.” Other employees supported the plaintiff’s claim that it was “‘common practice in the dealership for the white employees to make ethnic jokes.'”

In February 2010, plaintiff Manuel Quinones filed a lawsuit against Atlantic Hyundai, owned by John Staluppi, alleging racial discrimination while he was an employee at the dealership. The plaintiff claimed, “that Daniel Toomey, the manager who ultimately fired plaintiff, both made and tolerated remarks evoking a discriminatory attitude toward Puerto Ricans and Hispanics,” including saying, “”here comes one of your kind […] they’re all spics, they’re all the same.'” At least two employees supported Quinones’ claims that it was “‘common practice in the dealership for the white employees to make ethnic jokes'” and that “white employees often told Puerto Rican jokes in front of management, Daniel Toomey, and the employees.'” [Quinones v. Atl. Hyundai, 2010 U.S. Dist. LEXIS 16724; Quinones v. Atl. Hyundai, 2010 U.S. Dist. LEXIS 41401]

END NOTES

[1] Rachel Witkowski, “CFPB Continues Crackdown on Auto Lending Industry,” American Banker, 11/04/13

[2] Victoria Finkle, “House Democrats Request Details on CFPB Auto Lending Probe,” American Banker, 05/30/13

[3] Carter Dougherty, “House Democrats Seek Details on Consumer Bureau Auto Loan Rules,” Bloomberg, 05/30/13

[4] Zachary Warmbrodt, “GOP maneuver could put decades of regulations at risk,” Politico Pro, 04/17/18